Paying employees through direct deposit is a convenient and effective method. It eliminates the need for physical checks and allows for seamless electronic transactions. However, it’s essential to understand the holiday schedule to ensure timely payments. In this article, we will explore the Quickbooks Direct Deposit holiday schedule for 2021 and provide you with all the information you need.

Overview of Quickbooks Direct Deposit

Quickbooks Direct Deposit is a feature that enables businesses to pay their employees electronically. Instead of issuing paper checks, funds are directly deposited into the employees’ bank accounts. It simplifies the payroll process and saves time and effort for both employers and employees.

Understanding the Holiday Schedule

The holiday schedule plays a crucial role in payroll management. It determines the dates when payroll must be submitted and processed to ensure employees receive their payments on time. Being aware of the holiday schedule is vital for accurate planning and preventing any delays or disruptions in payment processing.

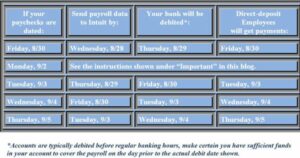

Quickbooks Direct Deposit Holiday Schedule 2021

Here is the holiday schedule for Quickbooks Direct Deposit 2021:

1. Christmas Day

- Deadline for submitting payroll: December 23rd

- Impact on payment processing: Payments may be delayed if submitted after the deadline.

2. New Year’s Day

- Deadline for submitting payroll: December 30th

- Impact on payment processing: Payments may be delayed if submitted after the deadline.

3. Independence Day

- Deadline for submitting payroll: July 2nd

- Impact on payment processing: Payments may be delayed if submitted after the deadline.

4. Thanksgiving Day

- Deadline for submitting payroll: November 24th

- Impact on payment processing: Payments may be delayed if submitted after the deadline.

Major Holidays and Payroll Deadlines

1. Christmas Day

- Deadline for submitting payroll: December 23rd

- Impact on payment processing: Payments may be delayed if submitted after the deadline. It is crucial to ensure payroll is submitted on or before the specified date.

2. New Year’s Day

- Deadline for submitting payroll: December 30th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Make sure to process payroll in advance to avoid any payment disruptions.

3. Independence Day

- Deadline for submitting payroll: July 2nd

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Plan accordingly to ensure payroll is processed on time.

4. Thanksgiving Day

- Deadline for submitting payroll: November 24th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. It’s essential to submit payroll early to avoid any payment delays during the holiday season.

Lesser-Known Holidays and Payroll Deadlines

Apart from the major holidays mentioned above, there are other holidays that may impact the payroll process. Here are some lesser-known holidays and their respective payroll deadlines:

1. Martin Luther King Jr. Day

- Deadline for submitting payroll: January 19th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Take note of this date and ensure timely submission of payroll.

2. Presidents Day

- Deadline for submitting payroll: February 16th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Plan accordingly to avoid any payment disruptions.

3. Labor Day

- Deadline for submitting payroll: September 7th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Make sure to adjust your payroll processing schedule accordingly.

4. Columbus Day

- Deadline for submitting payroll: October 12th

- Impact on payment processing: Payments may be delayed if submitted after the deadline. Keep this date in mind when planning your payroll processing.

Handling Payroll During Holidays

Managing payroll during holidays requires careful planning. Here are some tips to help you handle payroll effectively:

- Plan in advance: Take note of the holiday schedule and ensure you submit payroll ahead of the deadlines to avoid any delays in payment processing.

- Communicate with employees: Inform your employees about the holiday schedule and any changes to the regular payroll processing. This will help them understand the timing of their payments.

- Automate the process: Utilize payroll software like Quickbooks which offers direct deposit features and automatic scheduling. This ensures timely payments without manual intervention.

- Adjust for weekends and non-banking days: If a holiday falls on a weekend or a non-banking day, adjust your payroll processing accordingly to ensure employees receive their payments on the nearest business day.

Conclusion – Quickbooks Direct Deposit Holiday Schedule 2021

Understanding the Quickbooks Direct Deposit holiday schedule is vital for smooth payroll management. By following the designated deadlines and planning accordingly, you can ensure your employees receive their payments on time, even during holidays. Stay informed, communicate with your employees, and leverage automation tools to streamline the payroll process and avoid any payment disruptions.

Frequently Asked Questions (FAQs)

Q. What is the significance of the Quickbooks Direct Deposit holiday schedule?

The holiday schedule determines the deadlines for submitting payroll and ensures timely payments to employees during holidays.

Q. How can I find the Quickbooks Direct Deposit holiday schedule 2021?

You can find the Quickbooks Direct Deposit Holiday Schedule 2021 on the Quickbooks website or by contacting their customer support.

Q. Are there any exceptions to the holiday schedule?

It’s essential to follow the official Quickbooks Direct Deposit holiday schedule. Exceptions may cause payment delays.

Q. What happens if I miss the payroll deadline for a holiday?

Missing the payroll deadline may result in delayed payments to your employees. It’s crucial to adhere to the schedule to avoid any payment disruptions.