If you’re a business owner, you know how important it is to keep track of your financials. One of the key documents that you need to have in order to do this is the balance sheet. QuickBooks is a popular accounting software that can help you create and manage your balance sheet. In this article, we will discuss what QuickBooks balance sheet is, the benefits of using it, how to set it up, and how to get a QuickBooks balance sheet report.

What is a QuickBooks Balance Sheet?

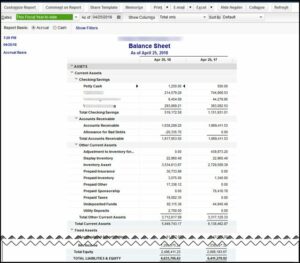

QuickBooks balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It is an important document for business owners because it provides a snapshot of the company’s financial health. The balance sheet helps business owners to understand the value of their assets, the amount of debt they owe, and the amount of equity they have in their business.

Benefits of Using QuickBooks Balance Sheet

Using balance sheet Quickbooks can benefit your business in many ways. Here are 10 benefits of using QuickBooks balance sheet:

- keep track of your business finances

- Analyzes the financial health of your company

- Make informed financial decisions

- Identify trends in your business finances

- Understand the value of your assets

- Track your liabilities and debts

- Understand the amount of equity you have in your business

- Identify areas where you can cut costs

- Plan for future growth and expansion

- Prepare for tax season

How to Setup QuickBooks Balance Sheets?

Setting up QuickBooks balance sheet is easy. Here are 10 steps to help you set up your balance sheet Quickbooks:

- Open QuickBooks and go to the “Lists” menu.

- Click on ” QuickBooks Chart of Accounts “

- The “New” button can be clicked to create a new account.

- Select “Balance Sheet” as the account type.

- Enter a name for the account, such as “Current Assets.”

- Enter the account balance.

- Click on “Save and Close.”

- Click on the “Reports” menu.

- Select “Balance Sheet” to view your QuickBooks balance sheet.

How to Get a QuickBooks Balance Sheet Report?

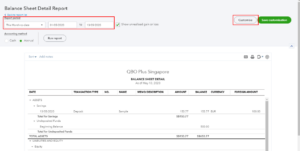

Getting a balance sheet Quickbooks report is also easy. Here are 10 steps to help you get your QuickBooks balance sheet report:

- The “Reports” menu can be found when you open QuickBooks.

- Select “Company and Financial.”

- Click on “Balance Sheet Standard.”

- Select the date range for the report.

- Choose whether you want to include or exclude zero balances.

- Select the basis of accounting.

- Choose whether you want to group accounts by “Account Type” or “No Grouping.”

- Click on “Refresh” to generate the report.

- Click on “Export” to save the report as a PDF or Excel file.

- Review the report to understand your company’s financial health.

Conclusion

In conclusion, QuickBooks balance sheet is an essential document for business owners who want to keep track of their finances. It provides a snapshot of a company’s financial health, including its assets, liabilities, and equity. Using QuickBooks balance sheet can help you make informed financial decisions, identify trends in your business finances, and plan for future growth and expansion.

Frequently Asked Questions (FAQs)

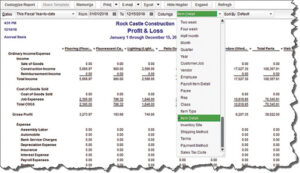

Q.1 What is the difference between a balance sheet and an income statement?

A balance sheet in QuickBooks shows a company’s assets, liabilities, and equity at a specific point in time, while an income statement shows a company’s revenues, expenses, and net income over a period of time. The balance sheet is a snapshot of a company’s financial health, while the income statement shows the company’s profitability over a period of time.

Q.2 What is the purpose of a balance sheet?

The purpose of a balance sheet is to provide a snapshot of a company’s financial health at a specific QuickBooks point of sale. It shows the company’s assets, liabilities, and equity, which helps business owners to understand the value of their assets, the amount of debt they owe, and the amount of equity they have in their business. The balance sheet is an important document for business owners because it helps them to make informed financial decisions.

Q.3 What is the difference between current assets and fixed assets on a balance sheet?

Current assets are assets that can be converted into cash within one year, such as inventory or accounts receivable. Fixed assets are assets that are expected to last longer than one year, such as property, plant, and equipment. Liquid assets are considered to be more liquid than fixed assets.