As a business owner, keeping track of your finances is crucial to staying on top of your business’s health. One of the most important tools in accounting is the chart of accounts, which is used to categorize all financial transactions. QuickBooks, a popular accounting software, offers a comprehensive and customizable chart of accounts that can simplify bookkeeping for businesses of all sizes. In this article, we’ll dive into what QuickBooks chart of accounts is, its benefits, and how to set it up.

What is a QuickBooks Chart of Accounts?

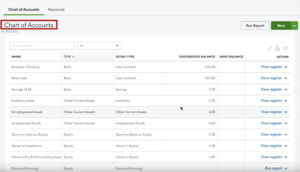

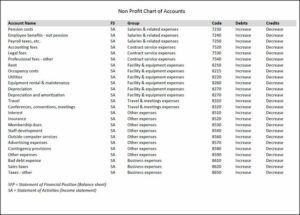

QuickBooks chart of accounts is a list of all accounts used by a business to classify financial transactions in the accounting software. It’s a complete list of a business’s accounts, including assets, liabilities, equity, income, and expenses. A unique account number, account name, and account type are assigned to each account. Chart of accounts QuickBooks provides a structured way to organize your financial data and makes it easier to prepare financial statements, reports, and tax returns.

Benefits of QuickBooks Chart of Accounts

- Accurate Financial Reporting: QuickBooks chart of accounts ensures accurate financial reporting by categorizing transactions correctly.

- Easy Record-Keeping: With a well-organized chart of accounts, it’s easy to keep track of all financial transactions.

- Time-Saving: QuickBooks chart of accounts automates repetitive tasks like data entry, saving time and effort.

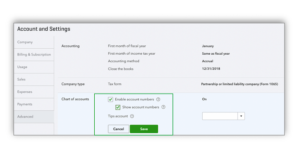

- Customizable: QuickBooks allows you to customize your chart of accounts to suit your business’s unique needs.

- Better Decision Making: Chart of accounts QuickBooks provides accurate financial information that can help business owners make better-informed decisions.

- Simplified Tax Preparation: QuickBooks chart of accounts streamlines the tax preparation process by categorizing expenses correctly.

- Improved Cash Flow Management: QuickBooks chart of accounts helps track QuickBooks cash flow, enabling businesses to make more informed decisions about spending and investments.

- Better Budgeting: QuickBooks chart of accounts helps businesses to develop more accurate budgets based on historical financial data.

- Enhanced Financial Visibility: With Chart of accounts QuickBooks, businesses have a clear picture of their financial health and can identify areas that need improvement.

- Scalable: QuickBooks chart of accounts is scalable and can be easily expanded as the business grows.

How to Set up a QuickBooks Chart of Accounts?

Setting up a chart of accounts in QuickBooks is simple and straightforward. Here’s how to do it:

- Open QuickBooks and select “Lists” from the top menu bar.

- Click the dropdown menu next to “Chart of Accounts”.

- Click on the “New” button to create a new account.

- Select the account type from the dropdown menu, such as asset, liability, equity, income, or expense.

- Name the account and assign a unique account number.

- If applicable, assign a sub account to the account.

- Save the account.

- Repeat the process for each account you want to add.

How to Set up a Sample Chart of Accounts in QuickBooks?

If you’re new to accounting or unsure where to start, QuickBooks provides a sample chart of accounts that you can use as a starting point. Here’s how to set up a QuickBooks sample chart of accounts:

- At the top of the screen, click the “Lists” menu to open QuickBooks.

- Choosing “Chart of Accounts” will bring up the dropdown menu.

- You will need to click the “New” button to create an account.

- Choose “Import” from the dropdown menu.

- Select “Chart of Accounts” and click “Continue.”

- Navigate to the location of the sample chart of accounts file and select it.

Conclusion:

In conclusion, setting up a QuickBooks Chart Of Accounts is an essential part of managing your business’s finances. With a well-organized chart of accounts, you can easily track your income and expenses, monitor your cash flow, and make informed financial decisions. The process of setting up a chart of accounts may seem overwhelming at first, but with the right tools and guidance, it can be a straightforward process. Remember to take the time to tailor your chart of accounts to your business’s specific needs, and don’t hesitate to reach out to QuickBooks support or consult with a financial professional if you need help along the way. By following the steps outlined in this article, you can set up a sample chart of accounts in QuickBooks and start managing your finances with confidence.

Frequently Asked Questions (FAQs)

Q.1 What is the purpose of the chart of accounts in QuickBooks?

The chart of accounts is a tool used in QuickBooks to organize and classify financial transactions. It lists all the accounts used in a company’s financial system and helps keep track of the company’s financial position. By using a well-organized chart of accounts, businesses can better understand their financial health and make informed decisions about their future.

Q.2 Can I customize my chart of accounts in QuickBooks?

Yes, you can customize your chart of accounts in QuickBooks to meet the unique needs of your business. You can add, delete, and edit accounts, as well as rearrange the order of accounts. Customizing your chart of accounts can help you better track your business’s finances and make informed financial decisions.

Q.3 How many accounts should I include in my chart of accounts?

The number of accounts you should include in your chart of accounts depends on the size and complexity of your business. However, as a general rule, you should include accounts for all of your income, expenses, assets, liabilities, and equity. It’s important to strike a balance between having enough accounts to provide useful information and not having too many accounts that make it difficult to manage.