Effective management of your business finances is a critical aspect of success. One of the biggest challenges that business owners face is managing their cash flow. Maintaining a steady cash flow can be the difference between thriving or struggling to stay afloat. In this article, we will explore QuickBooks cash flow, its benefits, and how to run a QuickBooks cash flow statement. We will also provide you with five solutions to optimize your cash flow, each with seven steps to follow.

What is QuickBooks cash flow?

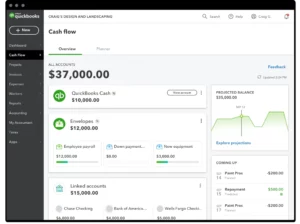

QuickBooks is a popular accounting software that provides business owners with an all-in-one financial management solution. It allows you to keep track of your expenses, invoicing, payroll, and even your cash flow. Cash flow QuickBooks is a feature that enables you to monitor and manage your cash inflows and outflows easily. It helps you to understand how much money is coming in and going out of your business, allowing you to make informed decisions.

How to Run a QuickBooks Cash Flow Report?

- Running a QuickBooks cash flow report is easy, and it can provide you with valuable insights into your business’s financial health. Here are the steps to follow:

- Log in to your Quickbooks account

- Click on the “Reports” tab on the left-hand side of the screen

- Choose “Cash Flow Statement” from the list of options after entering “cash flow” in the search bar

- Set the date range for the report you wish to generate

- Choose the format you prefer for your report (cash or accrual basis)

- Review and customize your report to fit your needs

- Save and export your report in the desired format (PDF, Excel, etc.)

Running a Quickbooks cash flow report regularly can help you identify trends and patterns in your cash flow, enabling you to make informed decisions to optimize your business finances.

Solutions to Optimize Your Cash Flow

In order to optimize your cash flow, there are several solutions you can implement. Here are five solutions with seven steps each to help you improve your cash flow:

Solution 1: Improve Your Invoicing Process

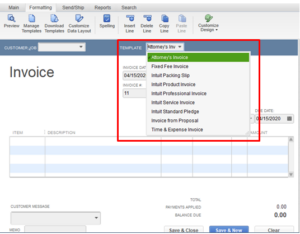

Step 1: Create a Clear Invoice Template

Make sure your invoice template is easy to read and understand. Include all relevant information such as the name of your business, the date, the client’s information, and a description of the services or products provided.

Step 2: Set Clear Payment Terms

Clearly outline your payment terms on the invoice. Indicate the due date, late payment fees, and accepted forms of payment.

Step 3: Follow Up on Late Payments

Send reminders for overdue payments and be persistent in your follow-up. Consider offering incentives for early payment.

Step 4: Automate Your Invoicing Process

Use accounting software such as QuickBooks to automate your invoicing process. You will save time and ensure accuracy by doing this.

Step 5: Offer Multiple Payment Options

Offer different payment options such as credit cards, PayPal, and bank transfers. This will make it easier for clients to pay on time.

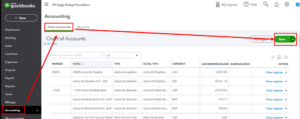

Step 6: Monitor Your Accounts Receivable

Keep track of your accounts receivable and take action if payments are overdue. Consider outsourcing your collections process if necessary.

Step 7: Analyze Your Invoicing Process

Regularly review your invoicing process and make improvements where necessary. This will help you stay on top of your cash flow and improve overall efficiency.

Solution 2: Control Your Expenses

Step 1: Create a Budget

Create a budget and stick to it. Keeping track of your expenses will help you avoid overspending.

Step 2: Monitor Your Expenses

Regularly review your expenses and identify areas where you can cut costs. Consider negotiating with vendors for better pricing.

Step 3: Automate Your Expense Tracking

Use accounting software such as QuickBooks to automate your expense tracking. In addition to saving you time, you will also ensure accuracy.

Step 4: Implement Cost-Saving Measures

Implement cost-saving measures such as energy-efficient lighting or telecommuting. This will help reduce your expenses and improve cash flow.

Step 5: Analyze Your Expense Management Process

Regularly review your expense management process and make improvements where necessary. This will help you stay on top of your cash flow and improve overall efficiency.

Solution 3: Manage Your Inventory

Step 1: Analyze Your Inventory Needs

Regularly analyze your inventory needs and adjust your ordering accordingly. This will help you avoid overstocking and understocking.

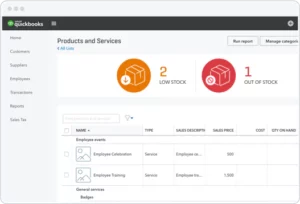

Step 2: Use Inventory Management Software

Use inventory management software to track your inventory levels and sales trends. This will help you make more informed ordering decisions.

Step 3: Negotiate with Suppliers

Negotiate with suppliers for better pricing and terms. This will help you reduce your costs and improve cash flow.

Step 4: Implement Just-in-Time Inventory

Implement just-in-time inventory practices to reduce storage costs and improve cash flow.

Step 5: Analyze Your Inventory Management Process

Regularly review your inventory management process and make improvements where necessary. This will help you stay on top of your cash flow and improve overall efficiency.

Conclusion

Managing your QuickBooks cash flow is crucial for the financial health of your business. By implementing the solutions outlined above, you can improve your invoicing process, control your expenses, manage your inventory, and manage your accounts payable. By doing so, you’ll be able to optimize your cash flow and ensure that your business stays afloat. Remember to regularly review your processes and make improvements where necessary in order to stay on top of your cash flow QuickBooks and improve overall efficiency. With the right strategies in place, you can take control of your finances and set your business up for success.

Frequently Asked Questions (FAQs)

Q.1 Can I customize the QuickBooks Cash Flow report?

Yes, you can customize the Cash flow QuickBooks report to suit your business needs. You can choose the time period you want to view, as well as the accounts and categories you want to include in the report. This can help you get a more detailed view of your cash flow and identify areas where you need to make adjustments.

Q.2 Can I use QuickBooks Cash Flow to forecast future cash flow?

Yes, you can use QuickBooks Cash Flow to forecast future cash flow based on your historical data. The software can help you identify trends and predict future cash inflows and outflows, so you can plan accordingly. This can be particularly helpful for businesses that experience seasonal fluctuations in cash flow.

Q.3 Is QuickBooks Cash Flow secure?

Yes, QuickBooks Cash Flow is secure. QuickBooks uses bank-level security protocols to protect your financial data and ensure that your information is safe. Additionally, Cash flow Quickbooks is subject to the same security standards and compliance regulations as other QuickBooks features, so you can feel confident in the security of your data.