As businesses grow and diversify, managing the finances of multiple entities becomes increasingly complex. Keeping track of multiple bank accounts, invoices, bills, and payments can be a daunting task. Quickbooks Multi Company is a powerful accounting solution that simplifies the management of finances for multiple entities. In this article, we will explore the features and benefits of Quickbooks Multi-Company and how it can help businesses streamline their accounting processes.

What is Quickbooks Multi Company?

Quickbooks Multi-Company is a feature of Quickbooks Enterprise that allows businesses to manage multiple companies from a single account. It enables businesses to track finances for different entities, such as subsidiaries, branches, and franchises, all in one place. Each entity has its own set of books, charts of accounts, and transactions, allowing for accurate and efficient accounting.

Features of Quickbooks Multi Company

Quickbooks Multi-Company has several features that make it an ideal accounting solution for businesses with multiple entities. Here are a few essential characteristics::

Shared Chart of Accounts

Quickbooks Multi Company allows businesses to share a QuickBooks chart of accounts across multiple entities. This feature simplifies accounting by eliminating the need to set up a new chart of accounts for each entity. Instead, businesses can use a single chart of accounts to manage finances across multiple entities.

Intercompany Transactions

Intercompany transactions are transactions between two or more entities within the same company. Quickbooks Multi-Company allows businesses to record intercompany transactions easily. This feature eliminates the need to create separate invoices or bills for each entity, simplifying the accounting process.

Consolidated Financial Statements

Quickbooks Multi-Company enables businesses to generate consolidated financial statements for multiple entities. This feature allows businesses to view the financial performance of all entities in one place, simplifying financial reporting and analysis.

User Access Control

Quickbooks Multi-Company allows businesses to control user access across multiple entities. This feature ensures that each user only has access to the entities and information that they need to perform their job, improving security and data privacy.

Benefits of Quickbooks Multi Company

Quickbooks Multi-Company has several benefits for businesses with multiple entities. Some of the main benefits are:

Simplifies Accounting

Quickbooks Multi Company simplifies accounting by allowing businesses to manage finances for multiple entities from a single account. This feature eliminates the need to switch between different accounting software or manually consolidate financial data.

Improves Accuracy

Quickbooks Multi-Company improves the accuracy of financial data by allowing businesses to track finances for each entity separately. This feature ensures that each entity’s financial data is accurate and up-to-date, improving financial reporting and analysis.

Increases Efficiency

Quickbooks Multi Company increases efficiency by eliminating the need to perform repetitive accounting tasks for each entity. This feature allows businesses to manage finances for multiple entities with minimal effort, freeing up time to focus on core business activities.

How to Add a Second Company to QuickBooks Desktop

QuickBooks Desktop allows users to manage multiple companies in one program, saving time and increasing efficiency. Here’s how to add a second company to QuickBooks Desktop:

Creating a New Company File

- To get started, log in to QuickBooks Account Desktop and then go to the “File” menu.

- Select “New Company” from the drop-down menu.

- Please choose between “Express Start” or “Advanced Setup” based on your specific requirements.

- Follow the on-screen prompts to set up the new company file, including the company name, industry type, and financial year.

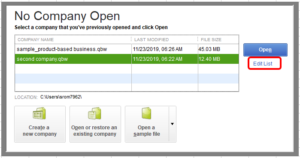

Opening Multiple Company Files

- To begin, launch QuickBooks Desktop and then select the “File” menu.

- Please choose “Open Second Company” from the available options in the dropdown menu.

- Please select the desired company file to open from the available options.

- Click “Open.”

How to Change the Company Name in QuickBooks Desktop

If you need to change the name of a company in QuickBooks Desktop, follow these steps:

- Open the company files you want to rename.

- To access “My Company,” simply click on the “Company” menu.

- Please click on the “Edit” button located next to the company name.

- Please enter the new name of the company and click on the “OK” button.

How to Delete Company in QuickBooks Desktop

If you no longer need a company in QuickBooks Desktop, you can delete it to free up space and simplify your program. However, before doing so, it’s crucial to back up your data and ensure that you won’t need it in the future.

Backing up Data Before Deleting

- Open the company file you want to delete.

- Please select “Create Backup” from the “File” menu.

- Choose the backup location and click “OK.”

- Wait for the backup process to complete.

Removing a Company File

- Close the company file you want to delete.

- Open Windows File Explorer and navigate to the location of the company file.

- Right-click on the company file and select “Delete.”

- Confirm the deletion.

Conclusion

Managing finances for multiple entities can be a daunting task for businesses. Quickbooks Multi Company is a powerful accounting solution that simplifies the management of finances for multiple entities. It enables businesses to track finances for different entities, such as subsidiaries, branches, and franchises, all in one place. Quickbooks Multi-Company has several features that make it an ideal accounting solution for businesses with multiple entities, including shared chart of accounts, intercompany transactions, consolidated financial statements, and user access control. Additionally, QuickBooks Desktop allows users to manage multiple companies in one program, saving time and increasing efficiency. By using Quickbooks Multi Company, businesses can streamline their accounting processes, improve accuracy, and increase efficiency, allowing them to focus on core business activities.

Frequently Asked Questions (FAQs)

Q1.Is Quickbooks Multi Company suitable for small businesses?

Quickbooks Multi-Company is a powerful accounting software solution that is designed to manage multiple entities and their financial transactions. While it may be tempting for small businesses to opt for this software, it may not be the most suitable option for them. Quickbooks Multi Company is more suitable for medium to large businesses that have multiple entities to manage.

Small businesses usually do not have multiple entities to manage, and they may not require the advanced features offered by Quickbooks Multi-Company. Quickbooks Online or Quickbooks Desktop may be more suitable for small businesses that require basic accounting and financial management tools.

Q2. Can I restrict user access to certain entities using Quickbooks Multi Company?

Yes, Quickbooks Multi-Company allows businesses to control user access across multiple entities. The software allows businesses to set up users and assign them access to specific entities, ensuring data privacy and security.

Businesses can also customize user permissions and set different levels of access based on their roles and responsibilities. This feature helps businesses ensure that sensitive financial information is only accessible to authorized personnel.

Q3. Can I generate consolidated financial statements using Quickbooks Multi Company?

Yes, Quickbooks Multi-Company enables businesses to generate consolidated financial statements for multiple entities. Consolidated financial statements provide a single view of the financial performance of all entities under the business’s control, simplifying financial reporting and analysis.

The software allows businesses to consolidate financial statements for multiple entities with ease. Businesses can also customize their financial statements and create different types of reports, such as balance sheets and income statements, for individual entities or the consolidated group. This feature enables businesses to get a clear picture of their overall financial health and make informed decisions based on the data.