W2 forms are an essential part of payroll processing for businesses that have employees. These forms show the amount of taxes withheld from an employee’s paycheck throughout the year and provide a summary of their earnings for the year. QuickBooks W2 Forms simplify this process by automatically generating W2 forms for your employees based on the data you’ve entered into QuickBooks.

What are QuickBooks W2 Forms?

QuickBooks W2 Forms are a feature of the QuickBooks Payroll system that allows businesses to generate W2 forms for their employees. W2 forms are essential documents that show the amount of taxes withheld from an employee’s paycheck throughout the year and provide a summary of their earnings for the year. These forms are required by the Internal Revenue Service (IRS) and must be provided to employees by January 31st of each year. The w2 forms for QuickBooks feature simplifies the process of generating W2 forms by automating the process based on data entered into QuickBooks. This saves businesses time and reduces the risk of errors due to manual data entry. QuickBooks W2 Forms are designed to ensure compliance with IRS regulations for W2 reporting and can be accessed directly from the QuickBooks Payroll dashboard.

Using QuickBooks W2 Forms is straightforward. Users can create W2 forms by selecting the Employees tab in the Payroll Center and clicking on the Payroll Tax Forms & W2s section. From there, users can choose the year for which they want to create W2 forms and select the employees for whom they want to create forms. The data on the forms can then be reviewed to ensure accuracy before printing and providing the forms to employees.

Benefits of Using QuickBooks W2

Using QuickBooks W2 Forms has several benefits for businesses:

- Time-saving: QuickBooks W2 Forms automate the process of generating W2 forms based on data entered into QuickBooks. This saves businesses time that would otherwise be spent manually entering data onto forms.

- Accuracy: By automating the process, w2 forms for QuickBooks reduce the risk of errors that can occur with manual data entry. This helps ensure that the information on the W2 forms is accurate and compliant with IRS regulations.

- Compliance: QuickBooks W2 Forms are designed to ensure compliance with IRS regulations for W2 reporting. By using this feature, businesses can feel confident that they are meeting their legal obligations.

- Convenient access: Print w2 forms in QuickBooks can be accessed directly from the QuickBooks Payroll dashboard. This makes it easy for businesses to find and generate the forms they need without having to search through paper records.

- Cost-effective: By automating the process, QuickBooks W2 Forms can help businesses save money on administrative costs associated with manually generating W2 forms.

How to Use QuickBooks W2 Forms?

Using QuickBooks W2 Forms is easy. Here are the steps:

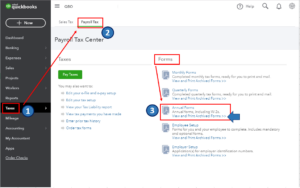

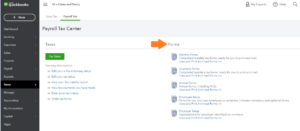

- Open QuickBooks and navigate to the Payroll Center.

- Select the Employees tab and click on the Payroll Tax Forms & W2s section.

- Click on the Create W2 Forms button.

- Choose the year for which you want to create W2 forms.

- Select the employees for whom you want to create W2 forms.

- Review the data on the forms to ensure accuracy.

- Print the forms.

- Provide the forms to your employees.

- File Copy A of the forms with the Social Security Administration (SSA).

- File Copy 1 of the forms with your state tax agency, if required.

How to Find Old W2 in QuickBooks Online?

Here are 10 simple steps to find an old W2 form in QuickBooks Online:

- Log in to your QuickBooks Online account using your credentials.

- Navigate to the “Workers” tab located in the left-hand menu.

- Click on the QuickBooks Self Employed for whom you need to find the W2 form.

- From the option available “Employee Details” page, then select the “Pay” tab option.

- Choose the year for which you need the W2 form.

- Click on the “View” option to the right of the “W2 Copies” section.

- This will open a new window with the employee’s W2 form for that year.

- If you need to download the W2 form, click on the “Download” button located in the top right corner of the form.

- If you need to print the form, click on the “Print” button also located in the top right corner of the form.

- Once you have finished downloading or printing the W2 form, close the window to return to the previous page.

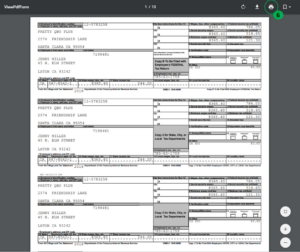

How to print w2 forms in QuickBooks desktop?

Steps to print W2 forms in QuickBooks Desktop are given below:

- Open QuickBooks Desktop and click on the “Employees” tab from the top menu bar.

- Select “Payroll Tax Forms & W2s” and then click on “Process Payroll Forms.”

- Choose the year for which you need to print W2 forms and click on the “W2 Forms” option.

- Select the employees for whom you want to print the W2 forms by checking the boxes next to their names.

- Click on “Review/Edit” to review and edit the information on the W2 forms, if necessary.

- Click on “Create PDF” to generate the W2 forms in a PDF format.

- Review the PDF forms and ensure that all the information is accurate and complete.

- Print the W2 forms by clicking on the “Print” button located at the bottom of the PDF viewer.

- If necessary, select the printer from the list of available printers and choose any printing preferences, such as paper size and print quality.

- Finally, click on “Print” to print the W2 forms.

Conclusion

QuickBooks W2 Forms can help streamline your payroll processing and save you time. By automating the process of generating W2 forms, you can minimize errors and ensure compliance with IRS regulations. With the easy-to-follow steps we’ve provided, you can use w2 forms for QuickBooks with confidence and ease.

Frequently Asked Questions (FAQs)

Q.1 What information do I need to enter into QuickBooks to generate a W2 form?

To generate a W2 form using QuickBooks, you will need to enter the employee’s personal information, including their name, address, Social Security number, and taxable wages for the year.

Q.2 Can I generate W2 forms for multiple employees at once using QuickBooks?

Yes, QuickBooks allows you to generate W2 forms for multiple employees at once. Simply select the employees you want to generate forms for and follow the prompts to enter their information.

Q.3 What happens if I make a mistake on a W2 form generated by QuickBooks?

If you make a mistake on a W2 form generated by QuickBooks, you will need to file a corrected form with the IRS. QuickBooks can generate corrected forms for you, but you will need to enter the correct information manually.