Are you tired of manually entering your bank transactions into QuickBooks? If so, you may want to consider using Direct Connect QuickBooks, a feature that allows for a direct connection between your bank and QuickBooks. In this article, we will discuss what QuickBooks Direct Connect is, how it works, and the banks that offer this feature, including Bank of America Direct Connect and PNC Direct Connect.

What is QuickBooks Direct Connect?

QuickBooks Direct Connect is a feature that allows you to automatically download your bank transactions directly into QuickBooks, eliminating the need for manual data entry. With Direct Connect QuickBooks, you can easily reconcile your accounts, categorize transactions, and keep your financial records up-to-date.

The Benefits of Using Direct Connect QuickBooks

By using QuickBooks Direct Connect, you can enjoy several benefits, such as:

- Saving Time: This eliminates the need for manual data entry, which can be time-consuming and prone to errors.

- Greater Accuracy: Direct Connect ensures that your financial records are accurate, as it eliminates the possibility of human error.

- Automatic Updates: With QuickBooks Direct Connect, your bank transactions are automatically updated, which means you can stay on top of your finances in real-time.

- Enhanced Security: This uses secure encryption technology to protect your data, which means you can rest assured that your financial information is safe.

How Does QuickBooks Direct Connect Work?

To use Direct Connect QuickBooks, you will need to first set up your bank account in QuickBooks. Once your account is set up, you can enable Direct Connect by following the instructions provided by your bank. After enabling Direct Connect, your bank transactions will automatically download into QuickBooks.

Step-by-Step Guide to Setting Up QuickBooks Direct Connect

Here is a step-by-step guide to setting up Direct Connect QuickBooks:

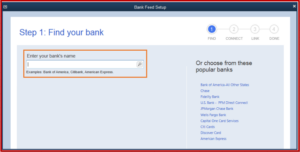

- Open QuickBooks Account and select the “Banking” tab.

- Click on the “Add Account” button.

- Search for your bank and select it from the list of options.

- Enter your bank login credentials.

- Select the account(s) you want to connect.

- Click on the “Connect” button.

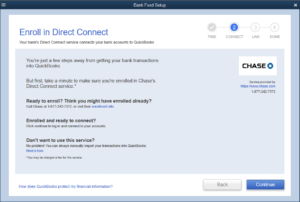

- Follow the instructions provided by your bank to enable Direct Connect.

Banks That Offer QuickBooks Direct Connect

Not all banks offer QuickBooks Direct Connect, but many do. Some of the banks that offer this feature include:

Bank of America Direct Connect QuickBooks

Bank of America Direct Connect QuickBooks allows you to connect your Bank of America accounts directly to QuickBooks, allowing for automatic downloads of your bank transactions. With Bank of America Direct Connect, you can also pay bills and transfer funds directly from QuickBooks.

PNC Direct Connect QuickBooks

PNC Direct Connect QuickBooks enables you to connect your PNC accounts directly to QuickBooks, allowing for automatic downloads of your bank transactions. With PNC Direct Connect, you can also transfer funds between accounts, pay bills, and receive alerts about your account activity.

Wells Fargo Direct Connect

Wells Fargo Direct Connect allows you to connect your Wells Fargo accounts directly to QuickBooks, allowing for automatic downloads of your bank transactions. With Wells Fargo Direct Connect, you can also pay bills and transfer funds directly from QuickBooks.

Chase Direct Connect

Chase Direct Connect enables you to connect your Chase accounts directly to QuickBooks, allowing for automatic downloads of your bank transactions. With Chase Direct Connect, you can also pay bills and transfer funds directly from QuickBooks.

US Bank Direct Connect

US Bank Direct Connect allows you to connect your US Bank accounts directly to QuickBooks, allowing for automatic downloads of your bank transactions. With US Bank Direct Connect, you can also pay bills and transfer funds directly from QuickBooks.

Conclusion

QuickBooks Direct Connect is a powerful feature that can help you streamline your accounting processes and stay on top of your finances. By eliminating the need for manual data entry, you can save time, increase accuracy, and enjoy greater peace of mind. If your bank offers Direct Connect QuickBooks, consider enabling it today to take advantage of its many benefits.

Frequently Asked Questions (FAQs)

Q1. Can I use QuickBooks Direct Connect with any version of QuickBooks?

Direct Connect QuickBooks is available in QuickBooks Desktop Pro, Premier, and Enterprise, as well as QuickBooks Online. However, not all versions of QuickBooks support Direct Connect, so you should check with your bank to confirm whether your version of QuickBooks is compatible.

Q2. How do I troubleshoot issues with Direct Connect QuickBooks?

If you’re experiencing issues with QuickBooks Direct Connect, there are several steps you can take to troubleshoot the problem. First, make sure that your bank account is set up correctly in QuickBooks and that you’ve enabled Direct Connect as instructed by your bank. You should also check to see if there are any software updates available for QuickBooks or your bank’s online platform. If you’re still having issues, you may need to contact your bank’s customer support or QuickBooks technical support for further assistance.

Q3. Is QuickBooks Direct Connect secure?

Yes, QuickBooks Direct Connect uses secure encryption technology to protect your financial data. When you enable Direct Connect, your bank login credentials are securely stored in QuickBooks and are never shared with third-party providers. Additionally, Direct Connect only downloads your bank transactions and does not allow for any other account activity, such as transfers or bill payments, without your explicit authorization. However, it’s important to note that you should always use strong passwords and two-factor authentication to further protect your financial information.