Employee Group Term Life Insurance (EE GTLI) is an essential employee benefit that provides financial protection to employees and their families in the event of the employee’s death. However, it’s important to understand the tax implications associated with this type of insurance coverage. This article aims to clarify the taxability of EE GTLI and provide a comprehensive overview of its tax treatment.

Understanding the Fundamentals of EE GTLI

How Does GTLI Work?

GTLI operates by pooling the life insurance coverage for a group of employees under a single policy. The employer typically pays the premiums for the coverage, making it a cost-effective option for employees. In the unfortunate event of an employee’s death, the insurance company pays a death benefit to the designated beneficiaries.

Eligibility Criteria for GTLI Coverage

Employees who meet certain criteria, such as being full-time or part-time employees, are generally eligible for EE GTLI coverage. The specific eligibility requirements may vary depending on the employer’s policy and the terms of the insurance provider.

Coverage Options and Policy Terms

GTLI policies typically offer a range of coverage options, allowing employees to select the level of coverage that best suits their needs. The policy terms may include the duration of coverage and any renewal provisions. Employees should carefully review the policy terms to understand the extent and limitations of their coverage.

Role of Employers in Offering EE GTLI

Employers play a crucial role in offering GTLI as part of their employee benefits package. They work with insurance providers to negotiate favorable terms and premiums on behalf of their employees. Employers may also facilitate the enrollment process and handle the administration of GTLI policies.

What is EE GTLI Taxable?

In the context of Group-Term Life Insurance (GTLI), EE GTLI taxable means the portion of the coverage provided to employees, commonly known as “EE GTLI” (short for employee GTLI), may be subject to taxation. The tax treatment of this depends on the total coverage amount and whether it exceeds a certain threshold.

According to the Internal Revenue Service (IRS) regulations in the United States, the cost of GTLI coverage up to $50,000 is generally considered tax-free. This means that if an employee’s GTLI taxable income does not exceed $50,000, the premiums paid for that coverage are not taxable as income. However, any coverage amount above $50,000 is generally considered taxable income to the employee.

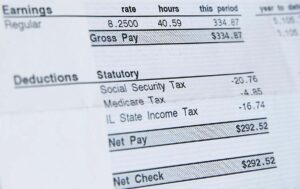

The taxable portion of EE GTLI coverage is determined based on a table provided by the IRS. The table assigns a monthly cost per $1,000 of coverage based on the employee’s age. To calculate the taxable amount, the cost per $1,000 is multiplied by the coverage amount exceeding $50,000 and by the number of months the coverage is in effect during the year.

It’s worth noting that employers are responsible for calculating and reporting the taxable portion of GTLI coverage, and the taxable amount is typically included in the employee’s W-2 form as wages. It’s advisable to consult with a tax professional or refer to the relevant tax regulations in your country for accurate and up-to-date information on the taxation of EE GTLI.

Tax Treatment of EE GTLI Premiums

One of the significant advantages of EE GTLI is that the premiums paid by the employee are usually excluded from their taxable income. This exclusion applies to premiums paid by both the employer and the employee. However, there are certain limits and restrictions on the amount of premium that can be excluded, particularly for high-income individuals. Employees need to be aware of these limitations to avoid any unexpected tax obligations.

Tax Treatment of EE GTLI Death Benefits

In general, the death benefits received from EE GTLI policies are tax-free for the beneficiaries. This means that the beneficiaries do not have to report the death benefits as taxable income on their tax returns. However, there are exceptions and limitations to this tax-free treatment. If the death benefits exceed certain thresholds set by the Internal Revenue Service (IRS), the excess amount may be subject to taxation. Additionally, death benefits from non-qualified plans and key employee coverage may have different tax implications.

Taxation of EE GTLI for Employers

From the employer’s perspective, the premium payments made towards EE GTLI policies may be tax-deductible as a business expense. However, employers must adhere to the reporting and record-keeping requirements set by the IRS. Failure to comply with these requirements could result in penalties or disallowance of the tax deduction.

Tax Implications for Employees

Employees should be aware that the value of EE GTLI coverage provided by their employers is required to be reported on their annual Form W-2. This reporting ensures transparency and helps the IRS monitor the tax compliance of individuals. It’s important for employees to accurately report their ee GTLI coverage to avoid any potential issues during tax filing. Furthermore, if an employee decides to cash out or surrender their EE GTLI policy, there may be tax implications on the cash value received.

Taxation of EE GTLI as a Fringe Benefit

The IRS classifies ee GTLI as a fringe benefit provided by employers to their employees. As such, specific rules exist for calculating and taxing the imputed income associated with this fringe benefit. Imputed income refers to the value of the EE GTLI coverage that exceeds $50,000, minus any amount paid by the employee toward the premium. This imputed income is subject to federal income tax and, in some cases, Social Security and Medicare taxes.

Advantages of Group-Term Life Insurance

Financial Protection for Employees and Their Families

GTLI provides a safety net for employees and their families by offering financial protection in the form of a death benefit. In the event of an employee’s untimely demise, the insurance payout can help cover funeral expenses, outstanding debts, and mortgage payments, and provide ongoing financial support for dependents.

Cost-Efficiency Compared to Individual Life Insurance

One of the significant advantages of GTLI is its cost-effectiveness. Since the employer often pays the premiums or shares the cost with employees, the coverage is generally more affordable compared to purchasing individual life insurance policies. This makes GTLI an attractive option for employees seeking life insurance coverage without the burden of high premiums.

No Medical Examinations Required

Unlike individual life insurance policies that may require medical examinations or underwriting, GTLI typically does not require employees to undergo such processes. This streamlined approach makes it easier for employees to obtain coverage, regardless of their health status or medical history.

Portability and Conversion Options

In some cases, GTLI policies may offer portability and conversion options. Portability allows employees to maintain their coverage even if they change jobs or leave the company. Conversion options enable employees to convert their GTLI coverage into individual life insurance policies if they decide to do so, typically within a specified time frame.

Coverage Details and Options

Death Benefit Amounts and Limits

GTLI policies specify the death benefit amounts, which are typically based on a multiple of the employee’s salary or a fixed amount predetermined by the employer. There may be limits on the maximum death benefit payout, and these details are outlined in the policy.

Term Length and Renewability

GTLI policies have specific terms that dictate the length of coverage. These terms can vary but commonly include one-year renewable periods. Employees should be aware of the policy’s expiration and renewal provisions to ensure continuous coverage.

Beneficiary Designations and Changes

Employees can designate beneficiaries who will receive the GTLI death benefit in the event of their passing. Employees need to keep their beneficiary designations up to date and make any necessary changes due to life events such as marriage, divorce, or the birth of a child.

Exclusions and Limitations

GTLI policies may have certain exclusions and limitations, such as suicide clauses or restrictions on coverage for specific causes of death. Employees must review the policy terms carefully to understand any limitations or circumstances under which the policy may not provide coverage.

Group-Term Life Insurance vs. Individual Life Insurance

Key Differences and Similarities

GTLI and individual life insurance are two distinct types of coverage with their characteristics. While EE GTLI is provided through an employer and offers coverage to a group of employees, individual life insurance is purchased directly by an individual. Both types provide financial protection but differ in terms of ownership, portability, and underwriting requirements.

Factors to Consider When Choosing GTLI or Individual Life Insurance

When deciding between GTLI and individual life insurance, employees should consider factors such as their financial needs, employment stability, and overall coverage requirements. It is advisable to evaluate the benefits and limitations of each option and choose the one that aligns best with their specific circumstances.

GTLI in the Workplace

Benefits for Employers in Offering GTLI

Employers offering EE GTLI as part of their employee benefits package can attract and retain talented employees. It demonstrates a commitment to their employees’ well-being and provides added financial security. Additionally, the cost of providing GTLI coverage is generally tax-deductible for the employer, making it a valuable investment.

Tax Implications for Employers and Employees

GTLI premiums paid by employers are typically considered a deductible business expense. However, the death benefit received by the employee’s beneficiaries may be subject to taxation. Employees should consult with a tax professional to understand the specific tax implications related to GTLI coverage and any potential taxable income.

Implementing GTLI for Employees

Enrollment Process and Timelines

Employers typically provide an enrollment period during which employees can sign up for GTLI coverage. The process may involve completing enrollment forms, designating beneficiaries, and providing necessary documentation. Employees need to adhere to the enrollment timelines to ensure timely coverage.

Employee Contributions and Premiums

Some employers may require employees to contribute towards the premiums for GTLI coverage, while others cover the entire cost. Employees should review their employer’s policy to understand if any contributions are required and the process for making premium payments if applicable.

Employee Responsibilities and Documentation

Employees have the responsibility to keep their EE GTLI information up to date, including any changes to personal details or beneficiary designations. They should promptly notify their employer or the insurance provider about any changes and provide the necessary documentation, such as marriage certificates or birth certificates, as required.

Claims and Payout Process

Reporting a Death Claim

In the unfortunate event of an employee’s passing, the designated beneficiaries or the employee’s family should promptly notify the employer or the insurance provider about the death claim. Employers usually have procedures in place to guide the claims reporting process.

Required Documentation and Proof

To initiate the claims process, the beneficiaries or the employee’s family will need to provide relevant documentation, such as a death certificate and any other supporting documents requested by the insurance provider. This documentation is essential for verifying the claim and facilitating the payout process.

Timelines for Claim Settlement

The insurance provider typically has specific timelines within which they aim to settle a EE GTLI claim. These timelines may vary, but the beneficiaries or the employee’s family must cooperate with the insurance provider, provide the necessary information promptly, and follow up to ensure a timely resolution.

Conclusion

Group-Term Life Insurance (GTLI) is an advantageous employee benefit that offers employees and their families essential financial protection. It offers advantages such as cost-efficiency, portability, and simplified enrollment processes. Understanding the fundamentals of EE GTLI, including eligibility criteria, coverage options, and the claims process, is essential for employees to make informed decisions regarding their life insurance needs. While GTLI provides important financial security, employees should also consider individual life insurance options based on their specific circumstances and coverage requirements. With its numerous benefits and the peace of mind it provides, GTLI continues to be a significant component of employee benefits packages in many organizations.

Frequently Asked Questions (FAQs)

Q. Who is eligible for EE GTLI coverage?

GTLI coverage eligibility varies depending on the employer’s policy, but it is generally available to full-time and part-time employees meeting certain criteria.

Q. Can employees customize their GTLI coverage?

The level of customization may depend on the employer’s policy and the options offered by the insurance provider. Employees should review their GTLI coverage options to understand the extent of customization available.

Q. Can employees convert EE GTLI to individual life insurance?

In certain cases, employees may have the option to convert their GTLI coverage into an individual life insurance policy within a specified time frame. The conversion options and terms are typically outlined in the policy.

Q. How are GTLI premiums calculated?

The calculation of GTLI premiums may vary based on factors such as the employee’s age, salary, and the coverage amount selected. Insurance providers use actuarial calculations to determine the premiums.