In the process of starting a small business, keeping track of finances can be intimidating. QuickBooks is an accounting software that helps make the process much more manageable. One essential aspect of QuickBooks is its categories, which help you organize your financial transactions. In this article, we will provide a comprehensive guide to QuickBooks categories, including what they are, how to use them, and why they are crucial for your small business.

What are QuickBooks Categories?

QuickBooks categories are labels used to classify your financial transactions in QuickBooks. They are designed to help you keep track of your income and expenses, assets, liabilities, and equity. With categories, you can group similar transactions together and easily generate reports that show your financial activity.

Why are QuickBooks Categories Important for Your Business?

Categories in QuickBooks are critical for your business for several reasons:

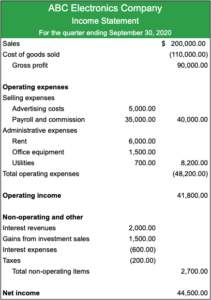

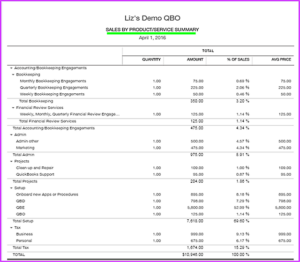

- Accurate financial reporting: Categories ensure that all transactions are accurately recorded, which is essential for generating accurate financial reports. These reports provide a comprehensive view of your business’s financial health, helping you make informed decisions.

- Better organization: By organizing your transactions into categories, you can quickly identify spending patterns, track expenses, and monitor income streams. This information can help you create a budget, plan for tax season, and optimize your business’s cash flow.

- Easy tax filing: Categories in QuickBooks simplify the tax filing process by ensuring that your financial transactions are properly categorized. By using categories, you can quickly generate tax reports, making it easy to file your taxes accurately and on time.

Types of QuickBooks Categories

QuickBooks has five main categories: expense, income, asset, liability, and equity.

Expense Categories

Expense categories are used to track the money spent by your business. They include rent, utilities, supplies, and other expenses necessary for running your business. Examples of expense categories include:

- Advertising and Marketing

- Office Supplies

- Rent and Lease Payments

- Travel and Entertainment

- Utilities

Income Categories

Income categories track the money your business receives from sales, services, and other sources. Examples of income categories include:

- Sales of Products

- Services

- Interest and Dividends

- Rental Income

Asset Categories

Asset categories are used to track items of value that your business owns, such as equipment, vehicles, and property. Examples of asset categories include:

- Buildings

- Equipment

- Furniture and Fixtures

- Land

- Vehicles

Liability Categories

Liability categories are used to track debts and other financial obligations your business owes, such as loans and credit card balances. Examples of liability categories include:

- Credit Card Balances

- Loans

- Payroll Liabilities

- Sales Tax Payable

Equity Categories

Equity categories track the money that has been invested in your business. They include owner’s equity and retained earnings. Examples of equity categories include:

- Owner’s Equity

- Retained Earnings

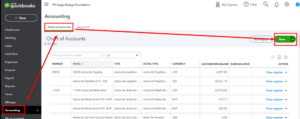

Creating QuickBooks Categories

Creating categories in QuickBooks is a straightforward process. You can create a new category by following these steps:

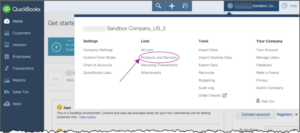

- Open QuickBooks and click on the Gear icon in the upper right-hand corner.

- Choosing “QuickBooks Chart of Accounts” will bring up the menu.

- On the upper right, click “New.”.

- Select the appropriate category type (e.g., expense, income, asset, liability, equity).

- Enter a name for the category (e.g., Rent, Sales of Products, Buildings).

- If desired, add a description to help you remember what the category represents.

- Click on “Save and Close.”

- Your new category will now appear in your Chart of Accounts, and you can begin using it to categorize your financial transactions.

Managing QuickBooks Categories

Managing your QuickBooks categories is an essential part of maintaining accurate financial records. Here are some tips for managing your categories effectively:

- Regular review: Regularly review your categories to ensure that they are accurate and up to date. If you notice any errors or inconsistencies, correct them as soon as possible.

- Consistent naming conventions: Use consistent naming conventions for your categories to make them easy to understand and use. For example, if you have multiple categories for rent payments, use names that clearly differentiate them (e.g., Rent – Office, Rent – Warehouse).

- Combine or split categories as needed: Over time, your business may change, and your categories may no longer accurately reflect your financial transactions. In these cases, consider combining or splitting categories to better align with your current business needs.

- Use subcategories: If you have a large number of categories, consider using subcategories to group similar categories together. For example, you might create a subcategory for “Utilities” and include categories for electricity, water, and gas bills.

- Archive unused categories: If you have categories that are no longer in use, consider archiving them to keep your Chart of Accounts clean and organized.

Best Practices for Using QuickBooks Categories

To get the most out Categories in QuickBooks, here are some best practices to follow:

- Be consistent: Consistency is key when it comes to categorizing your financial transactions. Make sure that all transactions are categorized consistently to ensure accurate reporting.

- Use automation: QuickBooks offers several automation tools that can help you categorize your transactions quickly and accurately. For example, you can set up rules to automatically categorize transactions from specific vendors or for specific types of expenses.

- Regularly reconcile your accounts: Regularly reconciling your accounts helps ensure that your categories are accurate and up to date. Bank Reconciliation QuickBooks also helps identify any discrepancies or errors that need to be corrected.

- Review reports regularly: Regularly reviewing your financial reports can help you identify areas where you can cut costs, optimize revenue, and improve your business’s overall financial health.

How to Edit Categories in QuickBooks?

To edit categories in QuickBooks, follow these steps:

- Open QuickBooks and go to the Chart of Accounts.

- Find the category you want to edit and click on it to select it.

- Click on the Edit button at the top of the screen.

- Make the desired changes to the category name, description, or other fields as needed.

- Click Save and Close to save your changes and return to the Chart of Accounts.

Conclusion

QuickBooks categories are an essential tool for small business owners to organize their financial transactions and generate accurate reports. By using categories effectively, you can better understand your business’s financial health, make informed decisions, and prepare for tax season. Remember to regularly review and manage your categories to ensure that they are accurate and up to date.

Frequently Asked Questions (FAQs)

Q.1 Can I create my own custom categories in QuickBooks?

Yes, you can create your own custom categories in QuickBooks to better reflect your business’s unique needs. To create a custom category, follow the same steps as creating a standard category, but select “Custom” as the category type. You can then enter a name for the category and add a description if desired.

Q.2 Can I change the name of a category after I’ve created it?

Yes, you can change the name of a category at any time. To do so, go to your Chart of Accounts, find the category you want to rename, and click on the name to edit it. Keep in mind that changing the name of a category will also change it on all associated transactions.

Q.3 Can I delete a category in QuickBooks?

Yes, you can delete a category in QuickBooks, but be aware that this will also delete all associated transactions. Before deleting a category, make sure that there are no transactions associated with it or that you have a backup of your QuickBooks data.