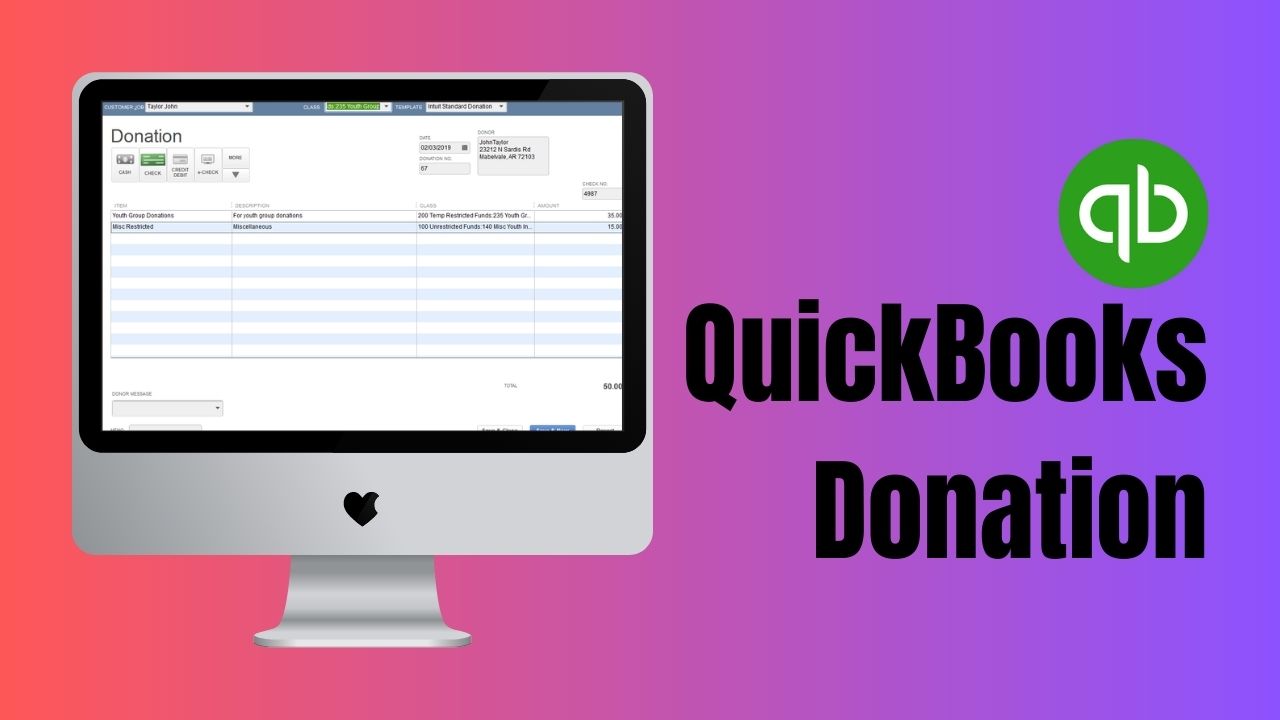

Donating to nonprofit organizations is a great way to give back to the community and support causes that you care about. However, the process of donating can be overwhelming and time-consuming, especially when it comes to managing financial transactions. QuickBooks, the popular accounting software, offers a simple and efficient solution for making donations to nonprofits with QuickBooks Donation. In this article, we will explore how to donate to nonprofits with QuickBooks, the benefits of using QuickBooks, how to record a donation in QuickBooks, and QuickBooks donation statements.

What is QuickBooks?

QuickBooks is an accounting software that helps businesses and individuals manage their financial transactions. It offers a range of features, including invoicing, expense tracking, and financial reporting, to help users keep track of their finances. QuickBooks is widely used by small and medium-sized businesses, accountants, and bookkeepers to streamline financial operations.

Why Donate to Nonprofits with QuickBooks?

Donating to nonprofits with QuickBooks Donation offers several benefits. First, it simplifies the process of making donations by providing a user-friendly interface. Second, it enables users to track their donations and generate reports for tax purposes easily. Third, it allows users to make donations quickly and securely, eliminating the need for paper checks or cash transactions. Fourth, QuickBooks provides a centralized platform for managing financial transactions, making it easy to keep track of all nonprofit donations in one place.

Benefits of Using QuickBooks Donation for Nonprofit Donations

Using QuickBooks for nonprofit donations offers several benefits, including:

- Efficiency: QuickBooks simplifies the process of making donations, enabling users to make donations quickly and securely.

- Organization: QuickBooks provides a centralized platform for managing financial transactions, making it easy to keep track of all nonprofit donations in one place.

- Tracking: QuickBooks allows users to track their donations and generate reports for tax purposes easily.

- Accuracy: QuickBooks eliminates the need for paper checks or cash transactions, reducing the risk of errors or fraud.

- Cost-effective: QuickBooks is a cost-effective solution for managing financial transactions, making it an ideal choice for small and medium-sized nonprofits.

How to Set Up QuickBooks for Nonprofit Donations

To donate to nonprofits with QuickBooks, you first need to set up your account to enable nonprofit donations. Here are the steps to follow:

- Open your QuickBooks account and select the “Lists” menu.

- Select “QuickBooks Chart of Accounts” from the drop-down menu.

- Click on “New Account” and select “Income” from the account type.

- Name the account “Donations” or a name of your choice.

- Click “Save and Close.”

How to Make a Donation with QuickBooks Donation

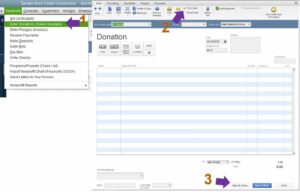

Once you have set up your QuickBooks account for nonprofit donations, you can proceed to make a donation. Here are the steps to follow:

- Open your QuickBooks account and select the “Customers” menu.

- Select “Create Invoices” from the drop-down menu.

- Enter the name of the nonprofit organization as the customer.

- Select the “Donations” account from the drop-down menu under “Item.”

- Enter the amount of your donation in the “Amount” field.

- Click “Save and Close.”

How to Record a Donation in QuickBooks

Recording a donation in QuickBooks is easy and straightforward. Here’s how to do it:

- Open QuickBooks and navigate to the “Customers” menu.

- Select “Enter Sales Receipts” from the drop-down menu.

- Choose the customer who made the donation.

- Enter the donation amount in the “Product/Service” field and select the appropriate account for the donation (e.g., “Charitable Contributions”).

- Save the sales receipt, and QuickBooks will record the donation in your financial records.

QuickBooks Donation Statements

QuickBooks enables users to generate donation statements for tax purposes easily. Here’s how to do it:

- Open QuickBooks and navigate to the “Reports” menu.

- Select “Donation Summary” from the drop-down menu.

- Choose the date range for the donations you want to include in the report.

- Select the donor’s name or select “All Donors” to generate a report for all donors.

- Customize the report to include any additional information you need.

- Preview the report, and if everything looks correct, save or print the report for your records.

Generating donation statements in QuickBooks can save you a lot of time and effort, especially during tax season.

Tracking and Reporting Nonprofit Donations in QuickBooks

QuickBooks Donation makes it easy to track and report nonprofit donations. Here are the steps to follow:

- Open your QuickBooks account and select the “Reports” menu.

- Select “Customers and Receivables” from the drop-down menu.

- Click on “Donations” or the name of the account you created for donations.

- Choose the date range for the report.

- Click on “Run Report.”

- Review the report to see a summary of all donations made to nonprofits during the selected period.

- You can also export the report to a CSV or Excel file for further analysis or tax reporting purposes.

Conclusion

Donating to nonprofits is a noble act of kindness that can make a significant difference in the lives of others. QuickBooks Donation simplifies the process of making donations to nonprofit organizations, enabling users to donate quickly and securely while keeping track of their donations for tax purposes. With its user-friendly interface and powerful financial management features, QuickBooks is a must-have tool for anyone looking to donate to nonprofits.

Frequently Asked Questions (FAQs)

Q1. Can I use QuickBooks to donate to international nonprofit organizations?

Yes, you can use QuickBooks Donation to donate to nonprofit organizations located anywhere in the world. QuickBooks allows you to make donations using a credit card or bank transfer, which can be used to donate to nonprofits in any country. However, it’s important to note that international transactions may be subject to additional fees or restrictions imposed by financial institutions or regulatory bodies. Therefore, it’s recommended to verify any potential fees or restrictions before making an international donation.

Q2. Can I use QuickBooks to track donations made by multiple users in my organization?

Yes, QuickBooks allows multiple users to access and manage the same account, making it easy to track donations made by different users in your organization. This feature is particularly useful for nonprofit organizations with multiple staff members or volunteers responsible for managing donations. Each user can be assigned a specific role, such as donation entry or report generation, and access can be restricted to specific features or data. QuickBooks also allows for easy tracking of individual contributions and provides reports on the total donations made by an individual, group, or organization as a whole.

Q3. Can I generate custom reports for nonprofit donations using QuickBooks Donation?

Yes, QuickBooks offers a range of customizable reporting features that allow users to generate reports based on their specific needs and requirements. Users can generate reports on donations made by a specific donor or to a specific nonprofit organization, and customize the date range or data fields included in the report. QuickBooks also allows users to create charts and graphs to visualize donation data, making it easy to identify trends and patterns. Custom reports can be used to help nonprofit organizations identify fundraising opportunities and develop strategies to increase donations.