In today’s digital age, credit card processing has become an integral part of running a business. QuickBooks, the popular accounting software, offers a reliable and easy-to-use credit card processing service. In this comprehensive guide, we will discuss everything you need to know about QuickBooks credit card processing.

What is QuickBooks Credit Card Processing?

QuickBooks credit card processing is a service provided by Intuit, the company behind QuickBooks accounting software. It allows businesses to accept credit card payments directly within the QuickBooks platform, making it easier for businesses to manage their finances and sales in one place. With QuickBooks credit card processing, businesses can accept payments from all major credit cards, including Visa, Mastercard, and American Express.

Benefits of QuickBooks Credit Card Processing

Using QuickBooks credit card processing offers several benefits to businesses, including:

Increased Efficiency

QuickBooks credit card processing streamlines the payment process by eliminating the need for manual data entry or double-entry bookkeeping. This reduces the risk of errors and saves time, allowing businesses to focus on other important tasks.

Better Cash Flow Management

QuickBooks credit card processing provides faster access to funds compared to traditional payment methods. Funds are typically deposited into the business’s bank account within one to two business days, which can help improve cash flow management.

Improved Customer Experience

QuickBooks credit card processing allows businesses to offer their customers more payment options, which can lead to higher customer satisfaction and repeat business. Additionally, QuickBooks credit card processing allows businesses to provide customers with accurate and timely receipts, improving the overall customer experience.

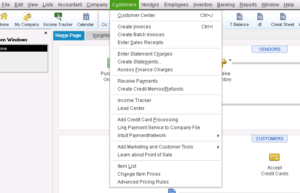

How to Set up QuickBooks Credit Card Processing?

To set up QuickBooks credit card processing, businesses need to follow these steps:

Step 1: Sign Up for QuickBooks

Businesses must first sign up for QuickBooks Account if they haven’t already done so. QuickBooks offers a variety of pricing plans to choose from, depending on the needs of the business.

Step 2: Apply for QuickBooks Payments

After signing up for QuickBooks, businesses need to apply for QuickBooks Payments. The application process is straightforward and can be completed online.

Step 3: Link QuickBooks Payments to QuickBooks

Once the application is approved, businesses can link QuickBooks Payments to QuickBooks. This will allow businesses to accept credit card payments directly within the QuickBooks platform.

Accept Credit Card Payments with QuickBooks

Accepting credit card payments with QuickBooks is simple and straightforward. Here’s how it works:

Step 1: Create an Invoice

To accept a credit card payment, businesses need to create an invoice within QuickBooks. The invoice should include the details of the product or service being sold, as well as the amount due.

Step 2: Send the Invoice to the Customer

Once the invoice is created, businesses can send it to the customer via email or mail. The invoice will include a link to a secure payment page where the customer can enter their credit card information.

Step 3: Receive Payment

Once the customer enters their credit card information and submits the payment, the funds will be deposited into the business’s bank account within one to two business days.

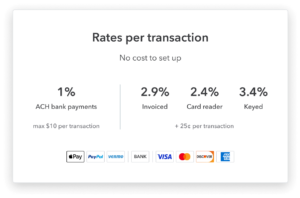

QuickBooks Credit Card Processing Fees

QuickBooks credit card processing charges a processing fee for each transaction. The fees vary depending on the payment method and the pricing plan chosen by the business. Generally, the fees range from 2.4% to 2.9% of the transaction amount, plus a flat fee of $0.25 to $0.50 per transaction.

QuickBooks also offers a pay-as-you-go pricing plan, which charges a higher processing fee but does not require a monthly fee or minimum transaction volume. Additionally, businesses can save on processing fees by choosing a monthly pricing plan that requires a monthly fee but offers lower transaction fees.

Security Measures for QuickBooks Credit Card Processing

QuickBooks credit card processing is designed to be secure and reliable. Intuit, the company behind QuickBooks, uses industry-standard security measures to protect the privacy and security of customer data. These measures include encryption, secure data centers, and fraud detection tools.

QuickBooks also complies with Payment Card Industry Data Security Standards (PCI DSS), which require businesses to adhere to strict security standards when processing credit card transactions.

Troubleshooting QuickBooks Credit Card Processing Issues

Despite its reliability, QuickBooks credit card processing may encounter occasional issues. If businesses encounter any issues with the service, they can contact QuickBooks support for assistance. QuickBooks support provides assistance with issues such as:

- Payment processing errors

- Connection issues

- Billing issues

- Integration issues

- Security concerns

Alternatives to QuickBooks Credit Card Processing

While QuickBooks credit card processing is a popular and reliable option for businesses, it may not be the best fit for all businesses. Some alternatives to QuickBooks credit card processing include:

- PayPal: PayPal is a popular payment processor that offers a variety of payment options, including credit card payments. It is easy to use and offers low transaction fees.

- Square: Square is a payment processor that allows businesses to accept credit card payments using a mobile card reader or online payment portal. It offers competitive pricing and easy integration with other software.

- Stripe: Stripe is a payment processor that offers a variety of payment options, including credit card payments. It offers a simple and easy-to-use platform, as well as competitive pricing.

Conclusion

QuickBooks credit card processing is a reliable and easy-to-use payment processing service that offers several benefits to businesses. With its streamlined payment process and efficient cash flow management, businesses can save time and focus on growing their business. By following the steps outlined in this guide, businesses can easily set up and use QuickBooks credit card processing for their payment processing needs.

Frequently Asked Questions (FAQs)

Q1. Can businesses accept credit card payments outside of QuickBooks credit card processing?

Yes, businesses can accept credit card payments outside of QuickBooks credit card processing. There are several other payment processors available that businesses can use to accept credit card payments. For example, PayPal, Square, and Stripe are all popular payment processing services that offer credit card payment options. Businesses can also accept credit card payments manually by using a credit card reader or by manually entering credit card information into a payment processor.

Q2. What happens if a customer disputes a credit card charge?

If a customer disputes a credit card charge, QuickBooks credit card processing will initiate a chargeback process to resolve the dispute. The chargeback process involves the customer’s credit card company investigating the disputed charge and determining whether or not it is valid. If the charge is determined to be invalid, the customer’s credit card company will reverse the charge and the business may be charged a chargeback fee. If the charge is determined to be valid, the business will be required to provide evidence to support the charge.

Q3. Can businesses use QuickBooks credit card processing to accept international payments?

Yes, QuickBooks credit card processing allows businesses to accept international payments. However, businesses may be charged additional fees for currency conversion and international transactions. Businesses should also be aware that there may be additional legal and regulatory requirements when accepting international payments, such as compliance with local tax laws and regulations.