Are you a business owner struggling with managing your employee payroll? If so, you’re not alone. Payroll can be a complicated and time-consuming task, especially when done manually. That’s where QuickBooks Payroll comes in. Intuit QuickBooks Payroll is a cloud-based payroll solution that helps you manage your employee payroll easily and efficiently. In this article, we’ll cover everything you need to know about QuickBooks Payroll, including how to run payroll in QuickBooks, how to log in, how to handle payroll deposits, and how to record payroll in QuickBooks.

What is Intuit QuickBooks Payroll?

QuickBooks Payroll is a cloud-based payroll solution that helps you manage your employee payroll easily and efficiently. This offers several features, including automatic tax calculation, direct deposit, and employee self-service. With Intuit QuickBooks Payroll, you can process payroll in just a few clicks, reducing the risk of errors and saving you time.

QuickBooks Payroll Login

Logging into QuickBooks Payroll is a simple process that can be done in just a few steps. Here’s how to log in to it:

- Open your web browser and navigate to the QuickBooks account login page.

- Enter your QuickBooks login credentials, including your user ID and password. If you have forgotten your login information, you can reset it by clicking on the “I forgot my user ID or password” link and following the prompts.

- Once you have logged in, you will be directed to your QuickBooks dashboard. From here, you can access all of the features and tools offered by QuickBooks Payroll.

If you don’t have an Intuit QuickBooks Payroll account, you can sign up for one on the QuickBooks website.

How to Setup Payroll in QuickBooks

Setting up payroll in QuickBooks involves a few key steps. To assist you in getting started, we have prepared a guide:

- Determine Your Payroll Needs: The first step in setting up payroll in QuickBooks is to determine your payroll needs. This includes deciding on your payroll schedule, employee classifications, and other relevant details.

- Set Up Your Payroll Information: Once you’ve determined your payroll needs, you can set up your payroll information in QuickBooks. This includes entering employee details such as name, address, and Social Security number, as well as their pay rate and tax withholding information.

- Configure Payroll Preferences: After entering your payroll information, you’ll need to configure your payroll preferences. This includes setting up payroll taxes, deductions, and other relevant payroll settings.

- Run a Test Payroll: Before running your first payroll, it’s a good idea to run a test payroll to ensure that everything is set up correctly. This will help you catch any errors or issues before you run an actual payroll.

- Run Your First Payroll: Once you’ve completed the previous steps, you’re ready to run your first payroll in QuickBooks. Simply enter the hours worked for each employee, review the payroll information, and click the “Create Paychecks” button to complete the process.

By following these steps, you can set up payroll in QuickBooks and ensure that your payroll process is efficient, accurate, and compliant with all relevant regulations.

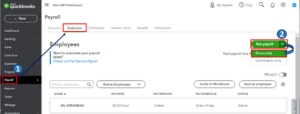

How to Run Payroll in QuickBooks

Running payroll in QuickBooks is a straightforward process that can be completed in just a few steps. Here’s how to run payroll in QuickBooks:

- Log in to your QuickBooks account and navigate to the Payroll Center.

- To start payroll processing, go to the “Employees” tab and click on the “Run Payroll” button.

- Choose the pay period for which you are running payroll.

- Enter the hours worked by each employee for the pay period, including any overtime or vacation time.

- Review the payroll information to ensure accuracy, including verifying employee deductions and taxes.

- To finalize the process, simply click on the “Submit Payroll” button.

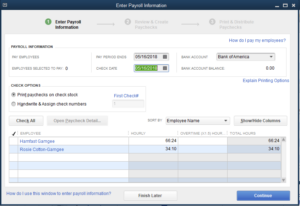

How to record payroll in QuickBooks

Recording payroll in QuickBooks is an important part of managing your business finances. Here’s how to record payroll in QuickBooks:

- Log in to your QuickBooks account and navigate to the Payroll Center.

- Select the “Employees” tab and click on the “Enter Payroll” button.

- Choose the pay period for which you are recording payroll.

- Enter the payroll information, including employee hours worked, salaries, bonuses, and any other compensation.

- Verify employee deductions and taxes, including federal and state income taxes, Social Security, and Medicare.

- Preview the payroll information to ensure accuracy and make any necessary corrections.

- To finalize the process, simply click on the “Create Paychecks” button.

Once you have recorded payroll in QuickBooks, you can generate reports and keep track of your business finances. QuickBooks Payroll will automatically calculate taxes and deductions, generate paychecks or direct deposits, and handle tax payments and filings.

It’s important to note that recording payroll in QuickBooks is just one part of managing your business finances. You should also keep track of all your business expenses, invoices, and payments to get a full picture of your financial situation. By using QuickBooks to manage your business finances, you can save time and streamline your financial processes.

QuickBooks Payroll not Deposited

If you have run payroll in QuickBooks but the funds were not deposited into your employee’s bank accounts, there are a few steps you can take to troubleshoot the issue:

- Check your payroll settings: Make sure that your payroll settings are correct and that you have set up direct deposit correctly. You can do this by navigating to the Payroll Center and selecting “Direct Deposit” from the menu. From here, you can check your bank account information, verify your employees’ bank information, and ensure that you have sufficient funds to cover payroll.

- Check for errors: Look for any errors or discrepancies in the payroll information you submitted, such as incorrect bank account numbers or insufficient funds. If you find any errors, you can correct them and resubmit payroll.

- Contact support: If you are unable to resolve the issue on your own, you can contact QuickBooks Payroll support for assistance. They can help you troubleshoot the issue and identify any errors or discrepancies that may be causing the problem.

It’s important to note that direct deposit can take up to two business days to process, so it’s possible that the funds simply haven’t been deposited yet. If you continue to have issues with QuickBooks Payroll not depositing funds, it’s best to reach out to support as soon as possible to avoid any further delays or issues.

Conclusion

Managing payroll can be a challenging task for any business owner, but with QuickBooks Payroll, it doesn’t have to be. Intuit QuickBooks Payroll offers a range of features that make it easy to run payroll, log in, handle deposits, and record payroll in QuickBooks. By following the steps outlined in this guide, you can streamline your payroll process, saving time and reducing the risk of errors.

If you encounter any issues or have additional questions, don’t hesitate to reach out to QuickBooks Payroll support. With their assistance and the features offered by QuickBooks Payroll, you can simplify your payroll process and focus on running your business.

Frequently Asked Questions (FAQs)

Q1. Can I use QuickBooks Payroll for multiple companies?

Yes, you can use QuickBooks Payroll for multiple companies. QuickBooks Payroll allows you to manage payroll for up to 50 companies with just one account. To set up payroll for each company, you’ll need to add each company as a separate entity within your QuickBooks account. Once you have added each company, you can manage their payroll information, employee data, and other payroll-related tasks from a single dashboard.

Q2. Can QuickBooks Payroll calculate taxes automatically?

Yes, QuickBooks Payroll can calculate taxes automatically based on the employee’s location and the payroll information entered. QuickBooks Payroll will calculate federal and state payroll taxes, Social Security, and Medicare taxes, and other applicable taxes based on your payroll settings. This helps to ensure that your employees are paid accurately and that your tax filings are correct.

In addition, QuickBooks Payroll will also handle tax payments and filings on your behalf, so you don’t need to worry about making payments or submitting paperwork to the government.

Q3. Is direct deposit available with QuickBooks Payroll?

Yes, direct deposit is available with QuickBooks Payroll. Direct deposit allows you to pay your employees electronically, directly to their bank accounts, instead of issuing paper checks. This saves time and reduces the risk of errors or lost checks. To set up direct deposit in QuickBooks Payroll, you’ll need to enter your employees’ bank account information and verify it. Once you have set up direct deposit, you can easily pay your employees electronically each pay period.

It’s important to note that there may be fees associated with using direct deposit, so be sure to check with your bank and QuickBooks Payroll for more information.