As a business owner, you need to be able to accept payments from your customers in a secure and efficient way. QuickBooks Merchant Services is a popular payment processing solution that can help you do just that. In this article, we’ll explore what Merchant Services in QuickBooks is, its benefits, support options, fees, and how to login.

What is QuickBooks Merchant Services?

QuickBooks Merchant Services is a payment processing solution that enables businesses to accept credit and debit card payments from their customers. It is designed to integrate with QuickBooks accounting software, making it easy to manage transactions and track sales. QuickBooks Merchant Services is a secure and reliable option for businesses of all sizes to streamline their payment processing. It offers customizable invoices, automatic payment reminders, mobile payments, recurring payments, and 24/7 customer support via phone, chat, or email. With QuickBooks Merchant Service, businesses can increase sales by attracting customers who prefer to pay with cards and improve QuickBooks cash flow by accepting multiple payment options and setting up recurring payments.

Benefits of QuickBooks Merchant Services

The benefits of using QuickBooks Merchant Services for your business:

- Increased Sales: With the ability to accept credit and debit card payments, you’ll be able to increase your sales by attracting customers who prefer to pay with cards.

- Easy Integration: QB Merchant Services seamlessly integrates with QuickBooks accounting software, making it easy to manage transactions and track sales.

- Customizable Invoices: You can customize your invoices with your logo, branding, and payment options to create a professional look and feel.

- Secure Payments: QuickBooks Merchant Services is PCI compliant and uses advanced security measures to protect your customers’ payment information.

- Mobile Payments: With QuickBooks Go Payment, you can accept payments on-the-go using your mobile device.

- 24/7 Support: Merchant Services in QuickBooks offers 24/7 contacting QuickBooks support via phone, chat, or email.

- Automatic Payment Reminders: You can set up automatic payment reminders for your customers to help you get paid on time.

- Quick Deposits: Funds from credit and debit card transactions are deposited into your bank account within 1-2 business days.

- Recurring Payments: You can set up recurring payments for customers who make regular purchases from your business.

- Multiple Payment Options: QuickBooks Merchant Services allows you to accept payments via credit cards, debit cards, and ACH bank transfers.

QuickBooks Merchant Services Support Work

QuickBooks Merchant Services offers comprehensive support to its users. If you encounter any issues with the payment processing or have questions about the service, you can contact the support team via phone, chat, or email. The support team is available 24/7 and is knowledgeable about the product and its features. They can assist you with anything from setting up your account to troubleshooting technical issues.

How to contact QuickBooks Merchant Services support team?

Here are the steps to contact the QuickBooks Merchant Services support team:

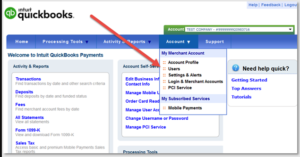

- Log in to your QB Merchant Services account using your login credentials.

- Click on the “Help” icon located in the top right corner of the screen.

- Search for help articles related to your issue or click on “Contact Us” to speak directly with the support team.

- Choose your preferred method of contact – phone, chat, or email.

How to QuickBooks Merchant Services Login?

The steps to login to QuickBooks Merchant Services:

- Open your preferred web browser and go to the QuickBooks Merchant Services login page.

- Please enter your User ID and Password in the appropriate fields.

- If you have forgotten your User ID or Password, click on the “Forgot Your User ID or Password?” link and follow the prompts to reset your credentials.

- Select the appropriate login option – “Sign In” for individual accounts or “Sign In With Intuit” for business accounts.

- Once you have entered your login information and selected your login option, click on the “Sign In” button.

- If this is your first time logging in, you may be prompted to set up additional security features or verify your identity.

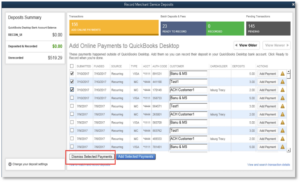

- After successfully logging in, you will be directed to your QuickBooks Merchant Services dashboard, where you can manage your payment processing and account settings.

Conclusion

QuickBooks Merchant Services is a reliable and secure payment processing solution that can help businesses of all sizes accept payments from their customers. With its easy integration, customizable invoices, and 24/7 support, it’s a great option for businesses looking to streamline their payment processing. Additionally, the ability to accept multiple payment options and set up recurring payments can help businesses increase sales and improve cash flow.

Frequently Asked Questions (FAQs)

Q.1 How long does it take to set up a QuickBooks Merchant Services account?

Setting up a QuickBooks Merchant Services account can be done in as little as a few minutes. However, it may take longer if additional verification or documentation is required, such as for high-risk businesses or businesses with large transaction volumes.

Q.2 Can I issue refunds with QuickBooks Merchant Services?

Yes, QB Merchant Services allows you to issue full or partial refunds directly from your account dashboard. Refunds can be processed for a variety of reasons, such as returns, cancellations, or disputes.

Q.3 What support options are available for QuickBooks Merchant Services users?

QuickBooks Merchant Services offers comprehensive support options, including phone, email, and chat support. Additionally, users can access a knowledge base of articles and resources on the QB Merchant Services website.