If you are a business owner or a payroll administrator, you know that managing payroll can be a tedious and time-consuming task. Payroll management involves keeping track of employees’ hours, calculating taxes and deductions, and making timely payments to employees. However, with QuickBooks Payroll Direct Deposit, you can streamline your payroll management process and save time and money. In this article, we will provide you with a comprehensive guide on Quickbooks direct deposit payroll, including what it is, its benefits, and how to set it up in ten simple steps.

What is QuickBooks Payroll Direct Deposit?

QuickBooks Payroll Direct Deposit is a service that allows employers to pay their employees electronically directly to their bank accounts. This service eliminates the need for paper checks and reduces the time and cost associated with printing, distributing, and reconciling checks. With Quickbooks direct deposit payroll, employees can receive their pay on time, and employers can avoid the risk of lost or stolen checks.

Benefits of QuickBooks Payroll Direct Deposit

- Save time and money: Direct deposit eliminates the need for printing, distributing, and reconciling paper checks, saving you time and money.

- Avoid lost or stolen checks: Direct deposit reduces the risk of lost or stolen checks and ensures that employees receive their pay on time.

- Improve cash flow: Direct deposit ensures that employees receive their pay on time, improving QuickBooks cash flow for both employees and employers.

- Reduce errors: Direct deposit eliminates errors associated with manual payroll processing, such as miscalculations and incorrect deductions.

- Secure and confidential: Direct deposit is secure and confidential, with bank-level encryption ensuring that employee information is protected.

- Easy to set up and use: QuickBooks Payroll Direct Deposit is easy to set up and use, with simple step-by-step instructions.

- Flexible payment options: Direct deposit allows employers to pay employees on a weekly, bi-weekly, or monthly basis, depending on their payroll schedule.

- Green and environmentally friendly: Direct deposit eliminates the need for paper checks, making it an environmentally friendly option.

- Accessible anywhere: Direct deposit allows QuickBooks self employed to receive their pay from anywhere, eliminating the need to visit a bank or cash a check.

- Compliance with labor laws: Direct deposit ensures compliance with labor laws, which require employers to pay their employees on time and provide them with accurate pay stubs.

How to Set Up QuickBooks Payroll Direct Deposit?

Setting up QuickBooks Payroll Direct Deposit is a simple and straightforward process. Follow these ten steps to set up Direct Deposit for your employees:

- Log in to your QuickBooks account and click on the “Employees” tab.

- Select “Payroll Setup” and then click on “Direct Deposit.”

- Follow the prompts to enter your company information, including your banking information and tax ID number.

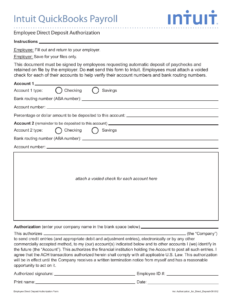

- Enter your employee’s banking information, including their account number and routing number.

- Verify your employee’s banking information by making two small deposits into their account.

- Once you receive confirmation of the deposits, return to QuickBooks and confirm the amounts of the deposits.

- Select the employees you want to enroll in Direct Deposit and enter their pay information, including their hourly rate or salary and deductions.

- Review and confirm the Direct Deposit information for each employee.

- Submit the Direct Deposit information to QuickBooks for processing.

- Pay your employees using Direct Deposit.

QuickBooks Payroll Deadline for Direct Deposit 2021

The deadline for submitting payroll for QuickBooks Payroll Deadline for Direct Deposit 2021 is dependent on your payroll schedule. If you pay your employees weekly or bi-weekly, you must submit payroll by 5:00 pm PT, two business days before the paycheck date. If you pay your employees monthly, you must submit payroll by 5:00 pm PT, five business days before the paycheck date.

It’s important to note that submitting payroll on time is crucial to ensuring that your employees receive their paychecks on schedule. Late submissions can result in delayed payments and potential penalties for non-compliance.

To avoid any issues, make sure to plan ahead and submit your payroll in a timely manner. With Quickbooks direct deposit payroll, the process is quick and easy, allowing you to focus on other aspects of your business while ensuring that your employees are paid accurately and on time.

Conclusion

In conclusion, QuickBooks Payroll Direct Deposit is an excellent solution for businesses looking to streamline their payroll management process. With its many benefits, including time and cost savings, improved cash flow, and increased security, Direct Deposit is an option that many employers are turning to for paying their employees. By following the ten simple steps outlined in this guide, you can set up Quickbooks direct deposit payroll for your business and enjoy the benefits it has to offer.

Frequently Asked Questions (FAQs)

Q.1 Is QuickBooks Payroll Direct Deposit secure?

Yes, QuickBooks Payroll Direct Deposit is secure and confidential, with bank-level encryption ensuring that employee information is protected.

Q.2 Can I pay employees on different schedules with QuickBooks Payroll Direct Deposit?

Yes, QuickBooks direct deposit payroll allows for flexible payment options, including weekly, bi-weekly, and monthly payments, depending on your payroll schedule.

Q.3 Is there a deadline for submitting payroll for QuickBooks Payroll Direct Deposit?

Yes, the deadline for submitting payroll for Quickbooks direct deposit payroll is dependent on your payroll schedule. If you pay your employees weekly or bi-weekly, you must submit payroll by 5:00 pm PT, two business days before the paycheck date. If you pay your employees monthly, you must submit payroll by 5:00 pm PT, five business days before the paycheck date.