The Paycheck Protection Program (PPP) was introduced by the United States government to support small businesses during the COVID-19 pandemic. QuickBooks, the popular accounting software, has developed a user-friendly platform to help small business owners apply for PPP loans. In this comprehensive guide, we’ll walk you through everything you need to know about QuickBooks PPP loans.

What is QuickBooks PPP loan?

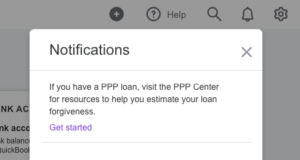

QuickBooks PPP loan is an online platform created by QuickBooks to help small business owners apply for PPP loans. QuickBooks is a popular accounting software used by millions of small business owners worldwide. The PPP loan is a government-funded loan program designed to support small businesses during the COVID-19 pandemic. The QuickBooks PPP loan forgiveness allows eligible businesses to apply for funding through the Paycheck Protection Program directly from within their QuickBooks account. The loan is designed to cover payroll costs, as well as other eligible expenses such as rent, utilities, and mortgage interest.

The loan amount is calculated based on a formula that takes into account the business’s average monthly payroll costs, and the funds can be used to cover payroll expenses for up to 24 weeks. The loan is forgivable if the business uses the funds for eligible expenses and meets certain other requirements.

Who is eligible for a QuickBooks PPP loan?

To be eligible for a QuickBooks PPP loan, you must be a small business owner who has been impacted by the COVID-19 pandemic. You must have less than 500 employees, and your business must have been in operation before February 15, 2020. Non-profit organizations, veterans’ organizations, and tribal businesses are also eligible for QuickBooks PPP loans.

How much can you borrow with a QuickBooks PPP loan?

The maximum amount you can borrow with QuickBooks PPP loan forgiveness is 2.5 times your monthly payroll costs. The payroll costs include salaries, wages, tips, commissions, and benefits. The maximum loan amount is $10 million, but most small businesses qualify for much less.

How to apply for a QuickBooks PPP loan?

- Log in to your QuickBooks account and navigate to the PPP loan application page.

- Review the eligibility requirements to ensure that you qualify for the loan.

- Enter basic information about your business, including your business name, address, and tax ID number.

- Provide details about your payroll costs, including the number of employees and their salaries.

- Upload supporting documents, such as payroll tax forms and bank statements.

- Review and submit your application.

- Wait for your application to be reviewed and approved by QuickBooks.

- You will receive a loan offer if your application is approved.

- Review the loan offer and accept the terms if you agree to them.

- Once you accept the loan offer, the funds will be deposited into your bank account within a few days.

How long does it take to get approved for a QuickBooks PPP loan?

The time it takes to get approved for a QuickBooks PPP loan can vary depending on several factors. Generally, the initial application process can be completed relatively quickly, typically within a few hours or days. However, the timeline for approval and funding can depend on the volume of applications being processed, the availability of funds, and any additional information or documentation that may be required.

Once you’ve submitted your initial application for a QuickBooks PPP loan forgiveness, your lender will review the application and may request additional documentation or clarification. It’s important to respond promptly to any requests from your lender to avoid delays in the approval and funding process. In general, the Small Business Administration (SBA) aims to process PPP loan applications and disburse funds within 10 business days of receiving a complete application. However, it’s important to note that the demand for PPP loans has been high, particularly during periods of increased economic uncertainty, which can impact the timeline for approval and funding.

What documents do you need to apply for a QuickBooks PPP loan?

You will need to provide the following documents to apply for a QuickBooks PPP loan:

- Payroll documentation, including tax forms and wage reports

- Bank account information

- Business tax returns

- Proof of business ownership

How to calculate the loan amount for QuickBooks PPP loan?

Calculating the loan amount for a QuickBooks PPP loan is a crucial step in the application process. Here’s how to do it:

- Start by calculating your average monthly payroll costs for the last 12 months. This includes salaries, wages, commissions, tips, benefits, and state and local payroll taxes.

- Determine the maximum loan amount you’re eligible for by multiplying your average monthly payroll costs by 2.5. For example, if your average monthly payroll costs are $20,000, your maximum loan amount would be $50,000 ($20,000 x 2.5).

- If you are a business with a NAICS code beginning with 72, such as a restaurant or hotel, you may be eligible for a higher loan amount. In this case, you can multiply your average monthly payroll costs by 3.5 instead of 2.5 to determine your maximum loan amount.

How to Record PPP Loan Forgiveness in QuickBooks?

- Create an “Other Income” account: Go to “Lists” and select “QuickBooks Chart of Accounts“. Then, click on “New Account” and select “Income”. Choose “Other Income” and name the account “PPP Loan Forgiveness”.

- Record the forgiven amount: Go to “Banking” and select “Make Deposits”. In the “Deposit To” field, select the account where you received the PPP loan. Enter the forgiven amount in the “Amount” field and select the “PPP Loan Forgiveness” account in the “From Account” column.

- Create a journal entry: Go to “Company” and select “Make Journal Entry”. Enter the forgiven amount in the “Debit” column of the “PPP Loan Forgiveness” account. Then, enter the same amount in the “Credit” column of the account where you originally recorded the PPP loan.

- Record any remaining balance: If there is any remaining balance after forgiveness, record it as a liability by creating a new account under “Current Liabilities”. Name the account “PPP Loan Remaining Balance” and record the amount in the “Credit” column of the journal entry.

- Apply the journal entry to the loan: Go to “Banking” and select “Loan Payments”. Enter the remaining balance in the “Amount” field and select the account where you originally recorded the PPP loan. Then, apply the journal entry you created to the payment.

- Create a memo: Add a memo to the journal entry to indicate that it is related to PPP loan forgiveness.

- Verify the transactions: Review your accounts to ensure that the forgiven amount and remaining balance have been properly recorded and reconciled.

Conclusion

In conclusion, the QuickBooks PPP loan can be a valuable lifeline for small businesses struggling to stay afloat during the COVID-19 pandemic. With its streamlined application process and favorable terms, including a low interest rate and forgivable loan amounts, the QuickBooks PPP loan offers a way for eligible businesses to cover payroll costs and other necessary expenses during this challenging time.

It’s important to note that the PPP loan program is subject to changes in legislation and funding availability, so it’s essential for business owners to stay informed and up-to-date on the latest developments. Working with a financial professional or utilizing resources from the Small Business Administration (SBA) can be helpful in navigating the process and making informed decisions.

Frequently Asked Questions (FAQs)

Q.1 What documents are required to apply for a QuickBooks PPP loan?

To apply for a QuickBooks PPP loan, you’ll need to provide documentation to verify your eligibility and support your loan amount calculation. This includes payroll documentation, such as payroll tax filings and financial statements, as well as documentation to support your business’s existence and ownership. You may also need to provide additional documentation, such as proof of rent or mortgage payments, utility bills, and other eligible expenses.

Q.2 Can self-employed individuals apply for a QuickBooks PPP loan?

Yes, self-employed individuals are eligible to apply for a QuickBooks PPP loan. As a QuickBooks self-employed individual, you’ll need to provide documentation of your income and expenses, such as Schedule C or F tax filings, to calculate your loan amount.

Q.3 How long does it take to receive funding from a QuickBooks PPP loan?

The time it takes to receive funding from a QuickBooks PPP loan can vary depending on factors such as the volume of applications and the availability of funding. In general, the SBA aims to process applications and disburse funds within 10 business days of receiving a complete application.