Are you a business owner or contractor who needs to collect W9 information from vendors and clients? Are you using QuickBooks for your accounting and bookkeeping needs? Then, this article is for you! In this article, we will discuss everything you need to know about QuickBooks W9, including how to fill out the form, where to store the information, and how to generate reports.

What is QuickBooks W9?

QuickBooks W9 is a form used to collect tax information from vendors and contractors who are not employees. This form is required by the IRS for businesses that pay more than $600 in a calendar year to non-employees. The W9 form includes personal information such as the vendor or contractor’s name, address, and tax identification number (TIN).

Why Do You Need a QuickBooks W9?

As a business owner or contractor, it is essential to collect W9 information from vendors and contractors to ensure compliance with IRS regulations. The information provided on the W9 form is used to generate Form 1099-MISC, which is used to report income paid to non-employees. Failure to collect W9 information can result in penalties and fines from the IRS.

How to Fill Out a QuickBooks W9?

The QuickBooks W9 form can be filled out by QuickBooks Online Account or downloaded from the IRS website. The form includes several sections that need to be completed, including:

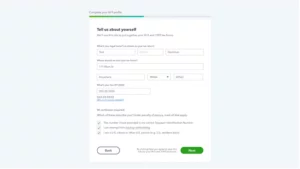

Personal Information

The first section of the form requires the vendor or contractor’s personal information, including their name, business name (if applicable), address, and TIN. If the vendor or contractor is exempt from backup withholding, they must indicate this in this section.

Federal Tax Classification

The second section of the form requires the vendor or contractor to indicate their federal tax classification. This includes indicating whether they are an individual or entity, as well as their tax classification, such as the sole proprietor, partnership, or corporation.

Exemptions

The third section of the form requires the vendor or contractor to indicate any exemptions they may have from backup withholding. This includes indicating whether they are exempt due to being a corporation, being exempt from FATCA reporting, or having made the proper certification.

Signature and Date

The final section of the form requires the vendor or contractor to sign and date the form, certifying that the information provided is accurate.

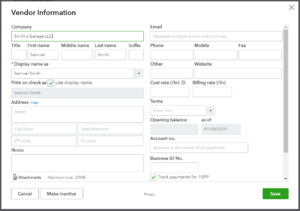

Where to Store QuickBooks W9 Information?

Once you have collected W9 information from vendors and contractors, it is essential to store this information in a safe and secure location. QuickBooks offers a vendor center where you can store vendor and contractor information, including W9 forms. This information can be easily accessed when generating 1099-MISC forms at the end of the year.

How to Generate QuickBooks W9 Reports?

Generating QuickBooks W9 reports is easy! QuickBooks offers a variety of reporting options, including 1099-MISC forms and vendor reports. To generate 1099-MISC forms, navigate to the vendors center and select “Prepare 1099s.” QuickBooks will guide you through the process of generating 1099-MISC forms, including selecting the vendors to include, verifying vendor information, and printing and filing the forms with the IRS.

QuickBooks W9 for Contractors

If you are a contractor who has been asked to provide W9 information to a client, it is essential to understand the information required and why it is necessary. Providing W9 information allows the client to accurately report income paid to you to the IRS, ensuring compliance with IRS regulations. Failure to provide W9 information can result in delayed payment or withholding of payment until the information is provided.

Conclusion

QuickBooks W9 is an essential tool for any business owner or contractor who needs to collect tax information from vendors and contractors. Filling out the form correctly and storing the information securely is crucial to ensure compliance with IRS regulations and avoid penalties or fines. QuickBooks offers a user-friendly platform for collecting and storing W9 information, as well as generating necessary reports, such as 1099-MISC forms.

Remember that as a contractor, providing W9 information to clients is crucial to ensure timely payment and compliance with IRS regulations. Take the time to fill out the form correctly and provide accurate information to avoid any delays or withholding of payment.

In summary, QuickBooks W9 is a necessary component of any business or contracting relationship that involves non-employees. With the right knowledge and tools, you can easily collect and store this information, ensuring compliance and peace of mind.

Frequently Asked Questions (FAQs)

Q1. What is the deadline for submitting W9 information to clients or vendors?

There is no specific deadline for submitting W9 information to clients or vendors. However, it is important to provide the information as soon as possible to avoid any delays in payment processing. It is also a good practice to request W9 information from vendors and contractors at the beginning of any business relationship, to ensure compliance from the outset.

Q2. What are the consequences of not providing W9 information to clients or vendors?

Failing to provide W9 information to clients or vendors can result in delays in payment processing, as well as potential penalties and fines from the IRS. Clients may also withhold a portion of payments until the W9 information is provided, in order to avoid potential tax liability. It is crucial to provide accurate and up-to-date W9 information to avoid any negative consequences.

Q3. Can QuickBooks automatically generate 1099-MISC forms based on W9 information?

Yes, QuickBooks can generate 1099-MISC forms based on W9 information collected from vendors or contractors. Simply navigate to the “Workers” tab in QuickBooks and select “Prepare 1099s” to get started. From there, you can select the vendors or contractors for whom you need to generate forms and QuickBooks will automatically populate the necessary information. This feature saves time and ensures compliance with IRS regulations.