Managing your finances as a business owner can be difficult. You need to keep track of your income and expenses, create budgets, and ensure that you have enough cash on hand to pay your bills. Fortunately, QB Cash Flow can help you streamline your financial management and ensure that your business stays profitable. In this article, we will explore the benefits of using QuickBooks Cash Flow Planner and how it can help you manage your business finances with ease.

Introduction to QuickBooks Cash Flow Planner

QuickBooks Cash Flow Planner is a financial management tool designed to help small business owners manage their cash flow more efficiently. This feature is available in QuickBooks Online, and it is a great tool for anyone looking to take control of their finances and plan for the future.

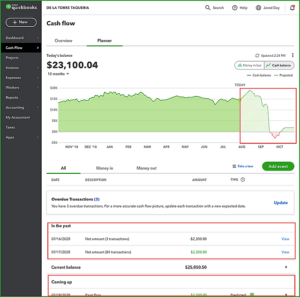

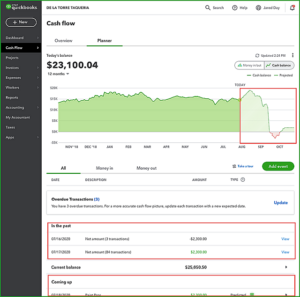

With QuickBooks Cash Flow, you can easily track your income and expenses, create budgets, and forecast your cash flow for the next 90 days. This tool uses artificial intelligence to analyze your past transactions and predict your future cash flow, giving you a better understanding of your business’s financial health.

Benefits of Using QuickBooks Cash Flow Planner

The benefits of using QuickBooks Cash Flow Planner are given below:

1. Streamline Your Financial Management

QuickBooks Cash Flow Planner helps you streamline your financial management by providing you with a clear view of your cash flow. You can easily track your income and expenses, create budgets, and forecast your cash flow for the next 90 days. This tool also helps you identify areas where you can reduce your expenses and increase your revenue, allowing you to make better financial decisions.

2. Maintain Control of Your Cash Flow

With Cash Flow QuickBooks , you can stay on top of your cash flow and ensure that you always have enough money to pay your bills. This tool uses artificial intelligence to analyze your past transactions and predict your future cash flow and create QuickBooks balance sheet, giving you a better understanding of your business’s financial health. You can also set alerts to notify you when your cash balance falls below a certain level, allowing you to take action before it becomes a problem.

3. Make Better Financial Decisions

QuickBooks Online Cash Flow Planner helps you make better financial decisions by providing you with the information you need to make informed choices. You can easily track your income and expenses, create budgets, and forecast your cash flow for the next 90 days. This tool also helps you identify areas where you can reduce your expenses and increase your revenue, allowing you to make better financial decisions.

4. Save Time and Money

By using QB Cash Flow Advisor, you can save time and money by streamlining your financial management. This tool helps you automate many of the tasks associated with financial management, such as tracking your income and expenses, creating budgets, and forecasting your cash flow. This allows you to focus on other aspects of your business, such as sales and marketing, and ensures that your finances are always up-to-date and accurate.

How to Use QuickBooks Cash Flow Planner?

The simple steps to use QuickBooks Online Cash Flow Planner are given below:

- Log in to your QuickBooks Online account.

- In the navigation menu, select the “QuickBooks Cash Flow” tab.

- Click on the “Get Started” button.

- Follow the on-screen instructions to set up your cash flow advisor.

- Choose your business accounts and connect them to QuickBooks.

- Verify your account balances and transactions.

- Categorize your transactions to accurately reflect your income and expenses.

- Review and adjust your budgets for the next 90 days.

- View your cash flow projections and make any necessary adjustments.

- Set up alerts to notify you when your cash balance falls below a certain level.

Conclusion:

In Conclusion, Cash Flow Planner also allows you to create what-if scenarios, so you can see how changes in your business operations could affect your cash flow. This feature is particularly useful when making decisions about investments, new hires, or major purchases. By using the cash flow advisor to model different scenarios, you can make informed decisions that are based on real data, rather than guesswork or assumptions.

Frequently Asked Questions (FAQs)

Q.1 How does QuickBooks Cash Flow Planner work?

QuickBooks Cash Flow Planner works by connecting to your business bank accounts and credit cards, and then analyzing your transactions to create a projection of your cash flow. It also allows you to create budgets and what-if scenarios, so you can model different financial scenarios and make informed decisions.

Q.2 Can I customize my cash flow projections in QuickBooks Cash Flow Planner?

Yes, Cash Flow advisor allows you to customize your cash flow projections by adjusting your budgets and categorizing your transactions. This allows you to create more accurate projections of your cash flow based on your business’s unique circumstances.

Q.3 Is QuickBooks Cash Flow Planner easy to use?

Yes, QuickBooks Cash Flow Planner is designed to be user-friendly and easy to use. It provides step-by-step instructions for setting up and using the tool, and its interface is intuitive and easy to navigate.