Homeowners associations (HOAs) are responsible for managing the financial aspects of communities, including collecting dues, paying bills, and creating budgets. The complexity of these tasks increases as the size of the community grows, and managing finances manually can become overwhelming. This is where QuickBooks comes in as a lifesaver for HOA management. QuickBooks is a powerful accounting software that can help HOAs streamline their financial management processes. In this article, we’ll explore the various features of QuickBooks and how they can be used to help HOAs save time and resources.

What is QuickBooks?

In addition to helping businesses manage their finances, QuickBooks is a cloud-based accounting software. It’s one of the most popular accounting software solutions in the market, with over 7 million active users worldwide. QuickBooks offers a variety of features to help businesses manage their finances, including invoicing, payroll, bank reconciliation, and expense tracking.

QuickBooks Features for HOA Management

Here are some of the key features of QuickBooks that can be used for HOA management:

1. Automated Dues Collection

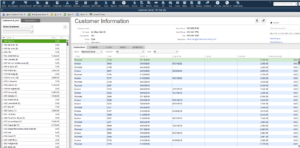

QuickBooks allows HOAs to automate the collection of dues from homeowners, making the process more efficient and less time-consuming. The software can automatically generate invoices, send reminders, and even process payments online, making it easier for homeowners to pay their dues on time.

2. Expense Tracking

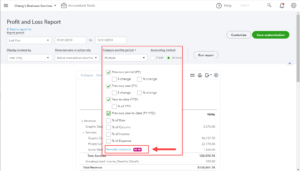

HOAs have various expenses that need to be tracked, including utilities, landscaping, and maintenance costs. QuickBooks allows HOAs to track these expenses and generate reports to help with budgeting and forecasting.

3. Budgeting and Forecasting

QuickBooks makes it easy for HOAs to create and manage budgets. The software can generate reports that show how much money is being spent and where, helping HOAs make informed decisions about future spending.

4. Bank Reconciliation

Bank reconciliation is a critical aspect of financial management, and QuickBooks simplifies the process. The software can automatically import bank transactions, allowing HOAs to quickly bank reconcile QuickBooks and identify any discrepancies.

5. Customizable Reporting

QuickBooks allows HOAs to create customized reports based on their unique needs. This makes it easy to track key metrics and monitor financial performance over time.

Benefits of Using QuickBooks for HOA Management

Here are some of the key benefits of using QuickBooks for HOA management:

1. Saves Time and Resources

Managing finances manually can be time-consuming and resource-intensive. QuickBooks automates many of the financial management processes, allowing HOAs to save time and resources.

2. Increases Accuracy and Reduces Errors

Manual financial management is prone to errors, which can be costly for HOAs. QuickBooks reduces the risk of errors by automating many of the financial management processes.

3. Improves Communication

QuickBooks makes it easy for HOAs to communicate with homeowners about financial matters. The software can send automated reminders and notifications, keeping homeowners informed about their dues and other financial matters.

4. Provides Better Visibility into Financials

QuickBooks generates detailed reports that provide better visibility into the financial health of the HOA. This information can help HOAs make informed decisions about future spending and budgeting.

5. Helps Ensure Compliance with Regulations

HOAs are subject to various regulations, including tax laws and reporting requirements. QuickBooks can help ensure compliance with these regulations by generating reports and tracking expenses.

How to use Quickbooks for HOA management?

To use QuickBooks for HOA management, follow these steps:

- Set up your QuickBooks account and HOA financial information

- Enter transactions and categorize them correctly

- Track expenses by category

- Generate financial reports to track performance

- Set up automatic payments for recurring expenses

- Use QuickBooks for budgeting

- Integrate QuickBooks with other software to streamline processes.

Conclusion

In conclusion, QuickBooks is an essential tool for HOA management. It can help HOAs save time and resources, increase accuracy and reduce errors, improve communication with homeowners, provide better visibility into financials, and ensure compliance with regulations.

Frequently Asked Questions (FAQs)

Q.1 What are the system requirements for QuickBooks?

QuickBooks is a cloud-based software, which means it can be accessed through a web browser on any device with an internet connection. There are no specific system requirements for QuickBooks, but it’s recommended to use a modern web browser and a stable internet connection for the best performance.

Q.2 Is QuickBooks secure?

Yes, QuickBooks is a secure software that uses encryption and other security measures to protect user data. QuickBooks is also compliant with various data security standards, including PCI-DSS and SOC 2.

Q.3 How does QuickBooks integrate with other software?

QuickBooks offers integrations with a variety of other software, including payment processors, expense tracking software, and payroll providers. These integrations allow HOAs to streamline their financial management processes and avoid manual data entry.

Q.4 Is QuickBooks easy to learn and use?

QuickBooks is designed to be user-friendly and easy to learn. The software offers a variety of resources, including tutorials and customer support, to help users get started and solve any issues they may encounter.