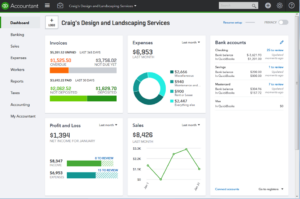

As a business owner, accepting credit card payments is crucial for smooth operations. However, to process credit card payments, you need authorization from the cardholder. QuickBooks, the popular accounting software, has a credit card authorization form that simplifies this process. In this article, we will guide you through everything you need to know about the QuickBooks credit card authorization form QuickBooks.

What is a Credit Card Authorization Form?

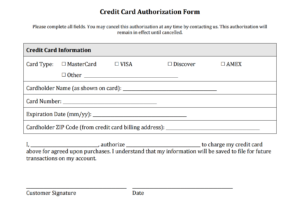

A credit card authorization form QuickBooks is a legal document that enables a merchant to charge a customer’s credit card for goods or services rendered. The form authorizes the merchant to charge the credit card account of the customer for a specific amount. It is an essential document for businesses that accept credit card payments, as it helps them protect themselves from chargebacks and fraud.

Why Do You Need a Credit Card Authorization Form in QuickBooks?

QuickBooks credit card authorization form is a convenient and easy way to obtain authorization from customers to charge their credit cards. The form allows businesses to automate the payment process, reducing manual errors and ensuring that payments are received promptly. It also helps to protect businesses from disputes, chargebacks, and fraud.

How to Create a QuickBooks Credit Card Authorization Form?

Creating a credit card authorization form in QuickBooks is a straightforward process. Here are the steps to follow:

Step 1: Open the Template Gallery

Open QuickBooks software and navigate to the Template Gallery. The Template Gallery is a collection of templates that you can use to create various forms, including invoices, estimates, and credit card authorization form QuickBooks.

Step 2: Select the Credit Card Authorization Form

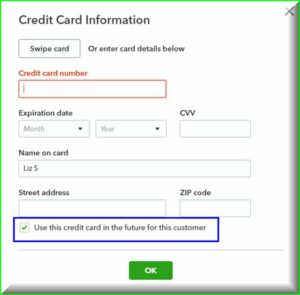

In the Template Gallery, select the credit card authorization form QuickBooks. This form has all the necessary fields for collecting credit card information, including the cardholder’s name, billing address, credit card number, expiration date, and the amount to be charged.

Step 3: Customize the Form

Customize the form by adding your business logo, name, and contact information. You can also include any additional fields that you require, such as the customer’s phone number or email address.

Step 4: Save and Use the Form

Once you have customized the form to your liking, save it and start using it to collect credit card authorizations from your customers. You can send the form to your customers via email or have them fill it out in person.

Tips for Using QuickBooks Credit Card Authorization Form

Here are some tips to help you get the most out of QuickBooks credit card authorization form:

Tip 1: Keep the Form Up-to-Date

Make sure to keep the credit card authorization form QuickBooks up-to-date by regularly reviewing and updating it. You can do this by adding new fields, removing outdated information, and making sure that the form complies with the latest regulations.

Tip 2: Educate Your Customers

Educate your customers on the importance of credit card authorization forms and why they need to sign them. Explain to them that the form protects both parties from fraud and disputes and ensures that payments are processed accurately.

Tip 3: Store the Forms Securely

Store the credit card authorization forms securely to protect your customers’ sensitive information. You can store them electronically or in a physical file cabinet with restricted access.

What is an ACH Authorization Form?

An ACH authorization form is a legal document that allows businesses to initiate electronic funds transfer (EFT) payments from a customer’s bank account. It is an essential document for businesses that want to automate their payment process and improve cash flow management. The form authorizes the business to initiate ACH debits from the customer’s bank account for a specific amount.

How to Create a QuickBooks ACH Authorization Form?

Creating an ACH authorization form in QuickBooks is a straightforward process. Here are the steps to follow:

Step 1: Open the Template Gallery

Open QuickBooks and navigate to the Template Gallery. The Template Gallery is a collection of templates that you can use to create various forms, including invoices, estimates, and ACH authorization forms.

Step 2: Select the ACH Authorization Form

In the Template Gallery, select the ACH Authorization Form. This form has all the necessary fields for collecting ACH information, including the customer’s name, bank routing number, account number, and the amount to be debited.

Step 3: Customize the Form

Customize the form by adding your business logo, name, and contact information. You can also include any additional fields that you require, such as the customer’s phone number or email address.

Step 4: Save and Use the Form

Once you have customized the form to your liking, save it and start using it to collect ACH authorizations from your customers. You can send the form to your customers via email or have them fill it out in person.

Conclusion

QuickBooks credit card authorization form is an essential tool for businesses that accept credit card payments. It simplifies the process of obtaining authorization from customers to charge their credit cards and helps protect businesses from disputes, chargebacks, and fraud. By following the steps outlined in this article and implementing the tips provided, you can create a credit card authorization form QuickBooks that is both effective and compliant.

Frequently Asked Questions (FAQs)

Q.1 How do I create a QuickBooks Credit Card Authorization Form?

Creating a QuickBooks Credit Card Authorization Form is easy. Open QuickBooks and navigate to the Template Gallery. Select the credit card authorization form QuickBooks, customize it by adding your business logo, name, and contact information, and any additional fields you require, and save it. You can then start using it to collect credit card authorizations from your customers.

Q.2 Can I send the QuickBooks Credit Card Authorization Form to my customers via email?

Yes, you can send the QuickBooks Credit Card Authorization Form to your customers via email. Simply attach the form to the email and send it to your customers. You can also have your customers fill out the form in person if they prefer.

Q.3 How often should I review and update the QuickBooks Credit Card Authorization Form?

You should review and update the QuickBooks Credit Card Authorization Form regularly to keep it up-to-date. You can add new fields, remove outdated information, and ensure that the form complies with the latest regulations.