If you have bad debt write it off in QuickBooks. In this post, we will show you how.

Writing off an invoice to bad debt in Quickbooks Online

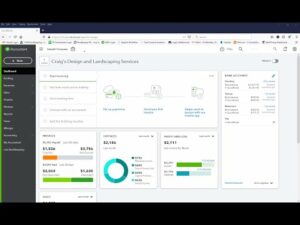

[ytvideo]Why Quickbooks is the best software for writing off bad debt

There are many software programs out there that can be used to write off bad debt, but Quickbooks is the best for a few reasons.

First, Quickbooks is an all-in-one software program that can be used to manage your finances, your business, and your taxes. This means that it is the perfect tool for writing off bad debt.

Second, Quickbooks makes it easy to track your expenses and your income. This makes it easy to see which loans and debts are costing you the most money, and it makes it easy to write them off as bad debt.

Finally, Quickbooks offers a great user interface that is easy to use and easy to learn. This means that even if you have never written off bad debt before, you should be able to use Quickbooks to do the job quickly and easily.

How to properly write off bad debt in Quickbooks

Bad debt write off is a process of subtracting the outstanding balances from your income statement, and writing that amount off your balance sheet as an expense. This will reduce your net income, and may affect your credit score.

There are a few things to keep in mind when writing off bad debt:

1. Make sure the debt is legitimate. Make sure the debt is actually owed and not just an estimate or mistake.

2. Consider the company’s financial situation. If the company is in debt trouble, it may be in a worse position to write off the debt.

3. Be realistic in your estimates. Don’t write off debts that you don’t think you can realistically pay back.

4. Be prepared to provide documentation. If you’re writing off a large debt, you may need to provide documentation such as cancelled checks or invoices.

5. Keep good records. You’ll need to keep track of all your write-offs, so you can identify any trends. This will help you avoid making any future errors.

What is considered bad debt?

There is no definitive answer to this question as it depends on the specific criteria that a business uses to classify a debt as bad. Generally speaking, however, a debt that is considered to be in default (meaning that the debtor has not paid the debt in full or on time) or that is considered to have high interest rates would be classified as bad debt.

How to avoid writing off bad debt

A quickbooks bad debt write off is a situation where you decide to write off a debt as a loss rather than continue to try and collect on it. This can be a difficult decision to make, especially if you feel like you have been struggling to pay off the debt for some time.

The main reasons to consider writing off a debt as a loss are as follows:

- It can help reduce your financial burden.

- It can improve your credit score.

- It can make it easier to get a loan in the future.When making the decision to write off a debt, it is important to keep these factors in mind. There are a number of things you can do to help make the process easier:

- Research the best bad debt write off options.

- Create a budget based on your specific financial situation.

- Set realistic goals for getting debt paid off.

- Make a timeline for completing the debt repayment process.

- Save all of your relevant documentation, including loan contracts and pay stubs.Once you have made the decision to write off a debt, there are a few steps you need to take to ensure the process goes smoothly. First, create a bad debt write off record. This will include all of the information you need to document the decision, including the reasons you chose to write off the debt.

Next, gather all of the relevant documents. This includes the loan contracts and pay stubs from

What are the consequences of writing off bad debt

There are a few consequences of writing off bad debt. The first is that it reduces the amount of money that the business owes its creditors. The second is that it reduces the amount of money that the business is liable for in future lawsuits. The third is that it makes it more difficult for the business to get new loans.

Conclusion

If you have bad debt in QuickBooks, you may be able to write it off as a deduction. There are a few things you’ll need to consider, though, and the process can be a bit complex. Talk to an accountant if you’re unsure of what to do.