QuickBooks is a powerful accounting software that helps businesses to manage their finances with ease. One of its key features is the ability to set up recurring payments, which can automate invoicing and save time for business owners. Whether you’re a small business owner or an accountant managing multiple clients, understanding how to use recurring payments in QuickBooks is essential.

In this article, we’ll take a deep dive into everything you need to know about recurring payments in QuickBooks. We’ll cover the different types of recurring payments, how to set them up, and tips for using them effectively. So, whether you’re new to QuickBooks or an experienced user, read on to learn more.

What are Recurring Payments in QuickBooks?

Recurring payments in QuickBooks are automated invoices that are sent to customers on a regular basis. This could be weekly, monthly, or quarterly, depending on the payment schedule you choose. The payment amount, frequency, and start and end dates can all be set up in advance, so you don’t have to worry about manually sending invoices each time.

Setting up Recurring Payments in QuickBooks

Setting up recurring payments in QuickBooks is easy and straightforward. Follow these simple steps to get started:

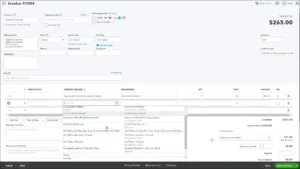

- Open QuickBooks and go to the “Customers” menu.

- Click on “Create Invoices” and select “Recurring Invoices.”

- Fill in the required information, such as the customer’s name, invoice amount, and payment schedule.

- Choose the items or services you want to include on the invoice.

- Save the recurring invoice template and you’re done!

Types of Recurring Payments in QuickBooks

There are two main types of recurring payments in QuickBooks: invoices and sales receipts. Invoices are typically used for services, while sales receipts are used for physical goods. Here’s a closer look at each type:

1. Invoices

Invoices are used for services that you provide to your customers on a regular basis. For example, you might provide web design services to a client on a monthly basis. With recurring invoices, you can automate the process of sending invoices, so you don’t have to worry about remembering to send them each month.

2. Sales Receipts

Sales receipts are used for physical goods that you sell on a regular basis. For example, you might sell a monthly subscription box to customers. With recurring sales receipts, you can automate the process of sending receipts, so you don’t have to worry about remembering to send them each month.

Tips for Using Recurring Payments in QuickBooks

Now that you know how to set up recurring payments in QuickBooks, here are some tips to help you get the most out of this feature:

- Make sure you have the correct customer information: Before you start setting up recurring payments, make sure you have all the necessary information for your customers, such as their name, address, and payment details.

- Review your invoices and sales receipts regularly: Make sure to review your recurring invoices and sales receipts regularly to ensure they’re accurate and up-to-date.

- Update your payment schedule as needed: If your payment schedule changes, make sure to update it in QuickBooks.

- Use automated reminders: QuickBooks offers the ability to set up automated reminders for customers who haven’t paid their invoices. This is a great way to keep on top of payments and avoid late fees.

- Keep track of payment history: QuickBooks makes it easy to keep record loan payment history for your recurring payments. You can view past payments and see when the next payment is due, making it easy to stay on top of your finances.

Conclusion:

Recurring payments in QuickBooks are a powerful tool for automating invoicing and streamlining your accounting process. Whether you’re a small business owner or an accountant, understanding how to use this feature can help you save time and stay on top of your finances. With the tips and information in this article, you should have everything you need to get started with recurring payments in QuickBooks. So, why wait? Start setting up your recurring payments today and take your accounting to the next level!

Frequently Asked Questions (FAQs)

Q.1 : Can I change the payment amount for a recurring payment in QuickBooks?

Yes, you can change the payment amount for a recurring payment in QuickBooks. Simply go to the recurring invoice or sales receipt, make the necessary changes, and save the updated template.

Q.2 : How do I stop a recurring payment in QuickBooks?

To stop a recurring payment in QuickBooks, go to the recurring invoice or sales receipt and select “Deactivate.” This will stop the recurring payment from being sent in the future.

Q.3 : Can I set up recurring payments for multiple customers in QuickBooks?

Yes, you can set up recurring payments for multiple customers in QuickBooks. Simply create a separate recurring invoice or sales receipt for each customer.