As a business owner or accountant, managing accounts receivable is a critical task. It is the money owed to you by your customers for goods and services rendered. One of the best ways to keep track of accounts receivable is to use accounting software like QuickBooks. QuickBooks offers an easy and efficient way to record accounts receivable journal entry QuickBooks, making it easier to track outstanding invoices and ensure timely payment. In this article, we’ll explore the steps to record accounts receivable journal entry in QuickBooks.

Understanding Accounts Receivable

In accounts receivable, a company is owed money by its customers for goods or services that were provided but not yet reimbursed. This money is considered an asset on the company’s QuickBooks balance sheet. Tracking accounts receivable is important because it affects a company’s cash flow and financial statements. When accounts receivable journal entry QuickBooks increases, it means that the company is making sales, but it also means that there is a delay in cash collection.

Why Use QuickBooks for Accounts Receivable?

One of the most common pieces of accounting software used by small businesses is QuickBooks. One of the reasons for its popularity is its ability to manage accounts receivable efficiently. QuickBooks can help you keep track of your invoices, send payment reminders to customers, and even create customized reports to analyze your accounts receivable. It’s also easy to use and saves time by automating many of the processes involved in managing accounts receivable.

Steps to Record Accounts Receivable in QuickBooks

Recording accounts receivable journal entry QuickBooks involves a few simple steps. Here’s how to do it:

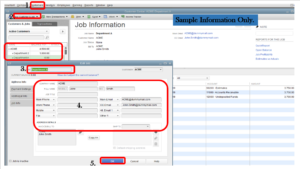

Step 1: Create a Customer Profile

The first step in recording accounts receivable journal entry QuickBooks is to create a customer profile in QuickBooks. This is where you’ll enter all the information about your customer, including their name, contact information, and payment terms.

Step 2: Create an Invoice

The next step is to create an invoice for the goods or services provided. QuickBooks makes it simple to create professional-looking invoices with all of the required information, such as the date, customer information, and item details.

Step 3: Record Payment

Once the customer has paid their invoice, you’ll need to record the payment in QuickBooks. To do this, go to the “Receive Payments” section and enter the amount received, the date of the payment, and the payment method.

Step 4: Reconcile Payments

It’s important to reconcile your accounts receivable journal entry QuickBooks to ensure that all payments have been recorded correctly. QuickBooks makes it easy to reconcile your accounts receivable by matching your invoices and payments automatically.

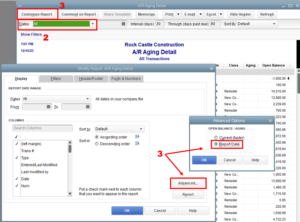

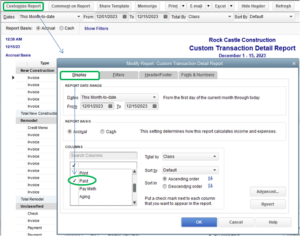

Step 5: Generate Reports

Finally, you can generate reports in QuickBooks to analyze your accounts receivable. QuickBooks offers a variety of reports that can help you track outstanding invoices, monitor cash flow, and analyze customer payment trends.

Tips for Managing Accounts Receivable

Here are some tips to help you manage your accounts receivable more efficiently:

- Set clear payment terms with your customers and communicate them clearly.

- Send invoices promptly and follow up with payment reminders as necessary.

- Consider offering early payment discounts or charging interest on late payments.

- Monitor your accounts receivable regularly and reconcile your accounts to ensure accurate recording of payments.

Conclusion

Managing accounts receivable journal entry QuickBooks is a crucial task for any business. QuickBooks offers an easy and efficient way to record accounts receivable journal entries, making it easier to track outstanding invoices and ensure timely payment. By following the steps outlined in this article and implementing the tips for managing accounts receivable, you can improve your cash flow and financial stability.

Frequently Asked Questions (FAQs)

Q.1 How do I record a partial payment for an invoice in QuickBooks?

To record a partial payment for an invoice in QuickBooks, go to the “Receive Payments” section and enter the amount received. Then, select the invoice for which the payment is being made and enter the amount of the payment. QuickBooks will automatically calculate the remaining balance due and update the invoice accordingly.

Q.2 How do I write off a bad debt in QuickBooks?

To write off a bad debt in QuickBooks, go to the “Customers” menu and select “Create Credit Memos/Refunds.” Enter the customer name and the amount of the bad debt, and select the account to which the bad debt will be written off. Then, save the credit memo and apply it to the open invoice.

Q.3 Can I set up automatic payment reminders in QuickBooks?

Yes, QuickBooks allows you to set up automatic payment reminders to remind your customers of outstanding invoices. You can customize the frequency and content of the reminders, and even choose which customers receive them.