If you’re a business owner or an accountant, you know how important it is to keep track of your financials. One of the most critical financial statements for any business is the profit and loss statement. In this article, we will take a deep dive into understanding the Profit and Loss statement QuickBooks.

What is a Profit and Loss Statement QuickBooks?

A QuickBooks profit and loss report, also known as an income statement QuickBooks, is a financial statement that reports a company’s revenues, expenses, and net income or loss for a specific period. The purpose of a QuickBooks P&L report is to show whether a business is profitable or not during a particular period.

Why is a Profit and Loss QuickBooks Statement Important?

A Profit and Loss statement QuickBooks is an essential financial document that helps business owners and accountants track their financial performance. It provides insight into the company’s revenue streams, expenses, and profitability. By analyzing a QuickBooks P&L report, business owners can make informed decisions about their operations, such as increasing revenue or cutting expenses.

How to Generate a QuickBooks Profit and Loss Report?

QuickBooks is a popular accounting software that offers a variety of financial reports, including Profit and Loss Statements. Here’s how to generate a Profit and Loss Statement QuickBooks:

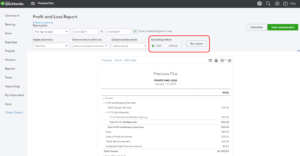

Step 1: Run a Report

From the home screen, click on the “Reports” tab on the left-hand side of the screen. Under “Recommended Reports,” select “Profit and Loss.”

Step 2: Customize the Report

In the QuickBooks P&L Report screen, you can customize the report by clicking on the “Customize” button. Here you can filter the report by date range, account type, and other criteria.

Step 3: Set the Date Range

Set the date range for the report. You can generate a QuickBooks Profit and Loss report for any period, such as a month, a quarter, or a year.

Understanding the Components of a Profit and Loss Statement QuickBooks

A QuickBooks Profit and Loss report consists of several components that provide insight into a company’s financial performance. Here are the key components of a Profit and Loss QuickBooks Statement:

Revenue

Revenue is a crucial financial metric that represents the income a company generates from its primary business activities. It includes the money earned from selling goods or services, as well as any other income generated from the company’s core operations. Revenue is an essential component of a company’s Profit and Loss Statement, as it directly impacts the calculation of gross profit and net income. By tracking and analyzing revenue trends, businesses can make informed decisions about pricing, product offerings, and sales strategies to maximize their financial performance.

Cost of Goods Sold

Cost of Goods Sold (COGS) is a crucial financial metric that represents the direct costs associated with producing the goods sold by a company. This includes the cost of raw materials, labor, and any other expenses incurred in the manufacturing process. COGS is a critical component of a company’s Profit and Loss Statement, as it directly impacts the calculation of gross profit and net income. By tracking and analyzing COGS trends, businesses can identify areas where they can reduce costs and improve their profitability, such as by optimizing their supply chain or improving their production processes.

Gross Profit

Gross Profit is the revenue a company generates minus the cost of goods sold. It represents the amount of money a company makes after deducting the direct costs associated with producing and delivering its products or services. Gross profit is an essential metric because it shows the efficiency of a company’s operations and its ability to generate profits from its core business activities.

Operating Expenses

Operating expenses are the costs associated with running a business, such as rent, salaries, utilities, and advertising expenses. These expenses are deducted from the gross profit to arrive at the operating income.

Operating Income

Operating income is the profit a company generates from its core business activities after deducting the operating expenses. It represents the profitability of a company’s primary business activities and does not include other income and expenses such as interest income or taxes.

Other Income and Expenses

Other income and expenses include non-operating income and expenses, such as interest income, interest expense, and taxes. These items are not related to a company’s core business activities and are added or subtracted from the operating income to arrive at the net income.

Net Income

Net income is the final figure on the Profit and Loss Statement and represents the total profit or loss a company has made during the period covered by the statement. It is calculated by subtracting all expenses from the revenues, including operating and non-operating expenses.

Tips for Reading and Analyzing a Profit and Loss Statement QuickBooks

Understanding a QuickBooks P&L report is essential for making informed financial decisions about a business. Here are some tips for reading and analyzing a QuickBooks Profit and Loss report:

- Pay attention to the revenue and gross profit figures to understand the efficiency of the company’s operations.

- Look at the operating expenses to identify areas where the company can reduce costs.

- Check the net income figure to determine whether the company is making a profit or a loss.

- Compare the current period’s Profit and Loss QuickBooks Statement to previous periods to identify trends and changes in the company’s financial performance.

Conclusion

In conclusion, a Profit and Loss Statement QuickBooks is an essential financial document that provides valuable insights into a company’s financial performance. By regularly generating and analyzing QuickBooks Profit and Loss report, businesses can identify areas where they can improve their financial performance, such as reducing costs and increasing revenues. QuickBooks is a popular accounting software that can help businesses automate their financial processes, including generating and analyzing QuickBooks P&L report. By following the tips and best practices outlined in this article, businesses can make informed financial decisions and improve their overall financial health.

Frequently Asked Questions (FAQs)

Q1. What is the difference between a Profit and Loss Statement and a Balance Sheet in QuickBooks?

A Profit and Loss Statement (QuickBooks P&L report) shows a company’s income, expenses, and net income or loss for a specific period. It is essentially a snapshot of the company’s financial performance over time. A QuickBooks Balance Sheet, on the other hand, provides a snapshot of a company’s financial position at a specific point in time, including its assets, liabilities, and equity. While a P&L focuses on a company’s revenues and expenses, a Balance Sheet provides a broader overview of the company’s financial health.

Q2. Can I customize the QuickBooks Profit and Loss Report to show specific data or time periods?

Yes, QuickBooks allows users to customize the Profit and Loss Statement QuickBooks to show specific data or time periods. Users can adjust the report’s date range, select specific accounts to include or exclude, and even create customized categories or sections to track specific data.

To customize the QuickBooks P&L report users should go to the Reports tab, search for “Profit and Loss,” select the report they want to customize, and then click the Customize Report button. From there, users can adjust the report’s settings to show specific data or time periods, and even save the customized report for future use.

Q3. How often should I review my company’s Profit and Loss Statement QuickBooks?

It is recommended that small business owners review their company’s QuickBooks Profit and Loss report at least once a month. This will allow you to track your company’s financial performance over time and identify any areas that may need improvement. By reviewing the P&L regularly, you can make informed decisions about your company’s finances and adjust your business strategy as needed. Additionally, reviewing the P&L on a regular basis will help you stay on top of your tax obligations and ensure that you are accurately reporting your company’s financial performance to the relevant authorities.